Two exchange-traded funds (ETFs) that permit traders to wager in opposition to Ethereum with leverage have emerged as finest performers year-to-date (YTD). Bloomberg Senior ETF analyst Eric Balchunas shared this on X, noting that he was not anticipating it.

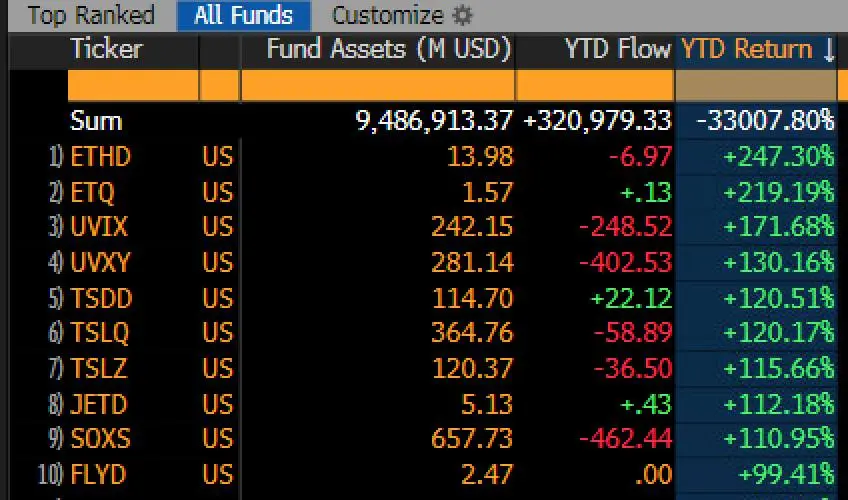

In line with Bloomberg information, the 2 ETFs, ProShares Ultrashort Ether ETF (ETHD) and T-Rex 2x Inverse Ether Each day Goal ETF (ETQ), are up 247.30% and 219% YTD, respectively. The 2x Lengthy VIX Futures ETFs, which Balchunas anticipated to come back first third.

Leveraged brief ETH Futures ETH are the perfect performers this yr. (Supply: Eric Balchunas)

Balchunas stated:

“The most effective performing ETF this yr is the -2x Ether ETF SETHD, up 247%. #2 is the opposite -2x Ether ETF. I used to be positive it might be SUVIX (2x VIX), however that’s #3. Brutal.”

Though the 2 ETH ETFs aren’t instantly shorting Ethereum however as a substitute use ETH futures contracts to wager in opposition to the asset, their high-flying efficiency highlights the token’s struggles. The token already has one in all its worst years on report, with an over 50% decline YTD and worth at unseen ranges since 2022.

Apparently, the 2 funds have minimal belongings underneath administration (AUM) with ETHD having $13.98 million in AUM after an outflow of $6.97 million this yr. ETQ is not any higher, with solely $1.57 million AUM regardless of a barely optimistic internet movement.

The 2 funds are additionally down on a long-term foundation. ETQ has had a unfavourable 3.56% efficiency in six months, whereas ETHD is down 18.09%.

Ethereum takes a break from struggles after a pause in tariffs

In the meantime, ETH took a break from its struggles with a greater than 10% surge in worth after President Donald Trump introduced a pause on tariffs for all nations besides China for 90 days. Following the information, ETH went from $1,440.82 to $1,687.18, sparking hypothesis of a rebound.

Unsurprisingly, the brief ETH ETFs additionally tanked in worth, with ETHD dropping 24% to $55.60 and ETQ falling 24.66% to $23.59. Nonetheless, they continue to be up YTD, and the outlook for ETH remains to be comparatively unfavourable, with the token already shedding a few of its current positive factors.

Regardless of its double-digit share positive factors, ETH stays effectively under $2,000, and optimistic sentiments are very slim. A part of the elements behind the worsening sentiment is the capitulation of some long-term holders.

In line with blockchain evaluation platform Lookonchain, one whale who has held ETH because it was price $8 not too long ago dumped 10,702 ETH for $16.86 million after two years of being dormant. The tackle has a historical past of promoting ETH throughout main dips, which provides to the rising ETH sell-0ff.

However, some market consultants imagine the selloffs by long-term holders may symbolize an excellent shopping for alternative. Crypto analyst Ali Martinez believes this might be an excellent entry level for many who wish to accumulate.

He stated:

“Lengthy-term #Ethereum $ETH holders have entered “capitulation” mode. For contrarians, this might sign a chief accumulation zone from a risk-reward standpoint.”

His view aligns with that of others who imagine ETH is already at a backside and has upcoming bullish occasions that would result in a worth enhance. Crypto influencer Ted Pillows believes that the Pectra improve, ETH staking ETFs, and tokenization booms may trigger ETH costs to extend considerably.

Nonetheless, many imagine the present market uncertainty doesn’t favor a rebound, and ETH may drop decrease. CryptoQuant analyst Mac_D has recognized $1,290 as the following main assist degree for ETH, as that is the place whales are holding over 100,000 ETH.