Main altcoin Ethereum (ETH) has skilled a notable worth surge over the previous 24 hours, breaking the $3,600 mark. As of this writing, ETH exchanges palms at $3,613, a degree it final traded at in June.

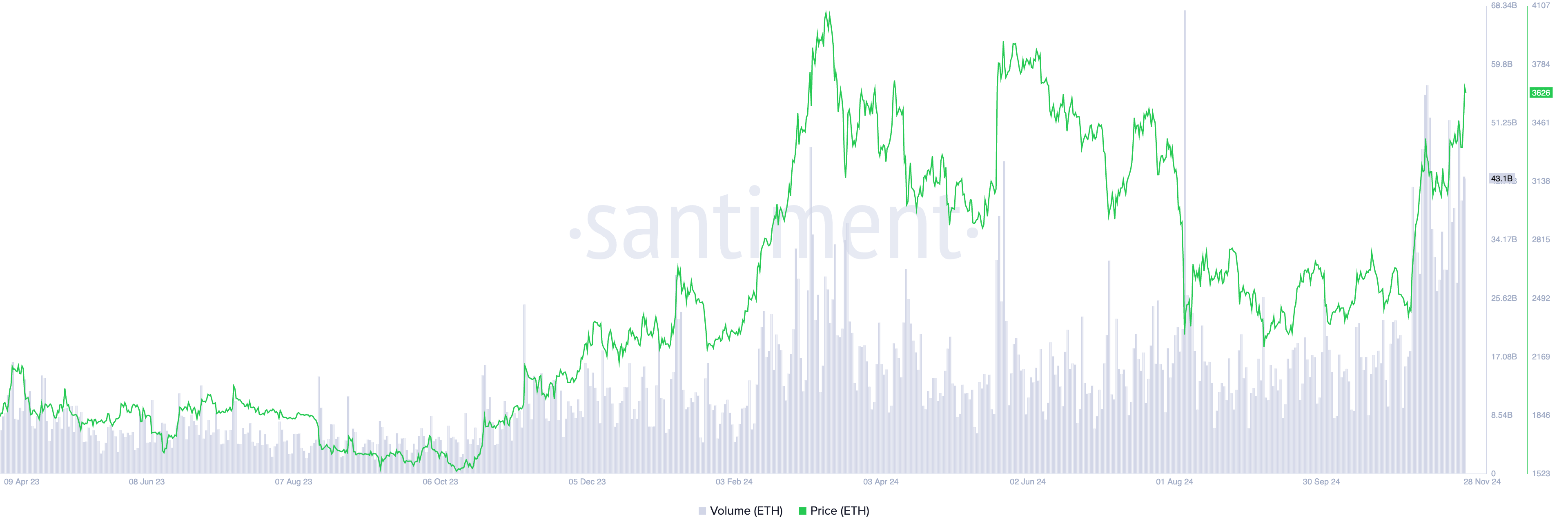

This rebound has been fueled by an enormous buying and selling quantity exceeding $43 billion up to now 24 hours. This hints at a sustained rally towards the psychological $4,000 worth mark.

Ethereum Worth Surge Hints at Altcoin Season

ETH’s buying and selling quantity has totaled $43 billion over the previous 24 hours. This surge in buying and selling exercise has propelled the coin’s worth to a worth final noticed 5 months in the past.

When an asset’s buying and selling quantity climbs alongside its worth, it signifies sturdy market curiosity and confidence within the upward motion. This mix means that the worth rally is backed by vital shopping for exercise, making it extra sustainable.

Subsequently, ETH’s excessive buying and selling quantity displays the uptick in market demand and broad participation. This reduces the probability of a sudden reversal.

Ethereum Worth and Buying and selling Quantity. Supply: Santiment

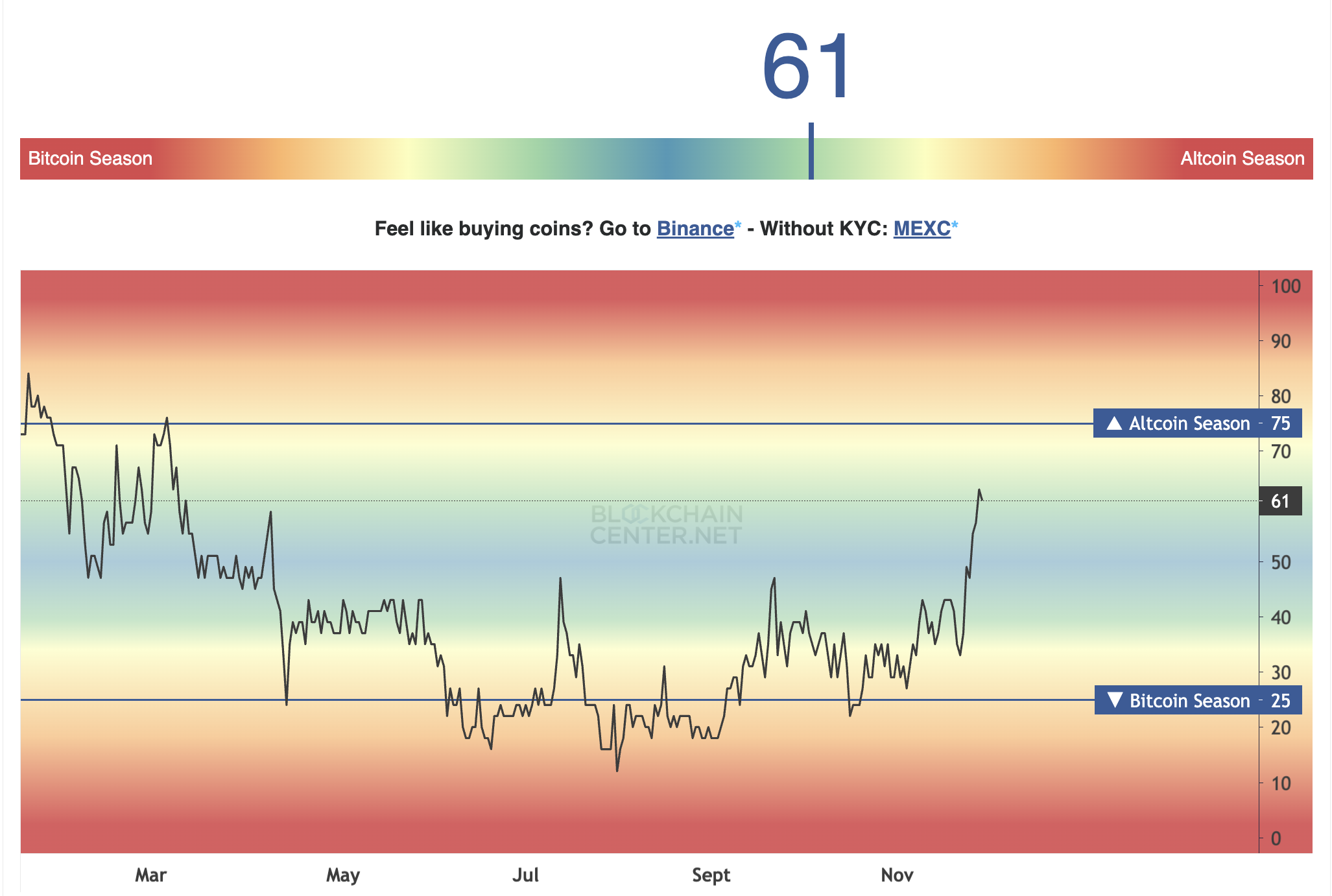

Additional, Ethereum’s current surge suggests a possible shift towards the altcoin season. In keeping with Blockchain Heart’s Altcoin Season Index (ASI), the rating now stands at 61 out of 100, nearing the 75-point threshold to sign the graduation of the highly-anticipated time.

Altcoin Season Index. Supply: Blockchaincenter

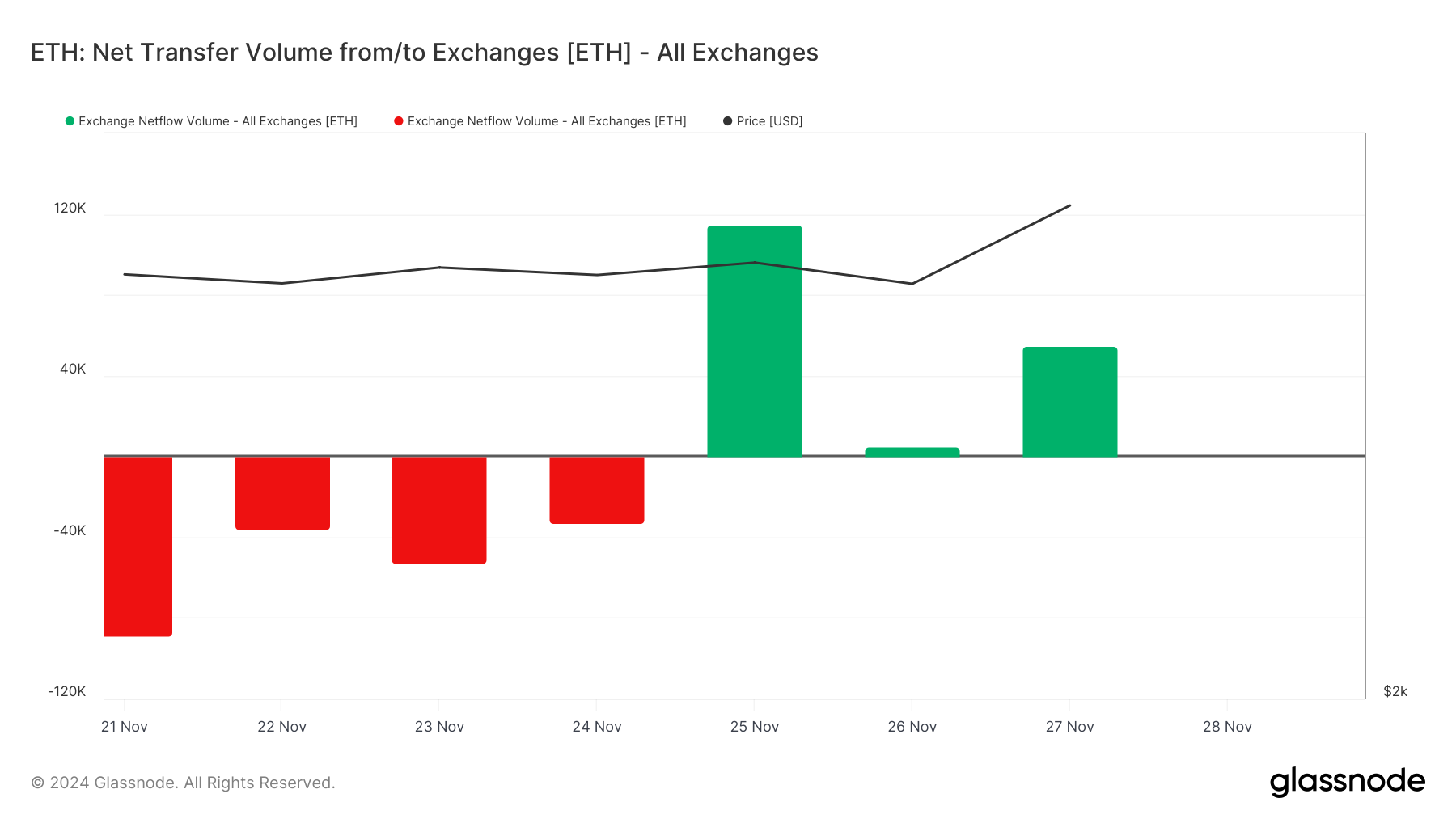

Notably, some profit-taking exercise is already underway attributable to this worth surge. That is mirrored within the coin’s constructive alternate netflow quantity. On Wednesday, 54,974 ETH valued above $199 million have been despatched to exchanges.

The alternate netflow quantity metric measures the distinction between inflows into and outflows from exchanges over a particular interval. When an asset’s netflow is constructive, extra cash are shifting into exchanges than leaving, usually signaling potential promoting stress as merchants put together to promote.

This enhance in provide on exchanges can weigh on the worth if demand doesn’t match the heightened availability.

Ethereum Netflow Quantity. Supply: Glassnode

ETH Worth Prediction: Rally Towards Yr-To-Date Excessive

Regardless of this, the general bullish sentiment within the Ethereum market stays sturdy, suggesting that the uptrend might persist. The setup of ETH’s Parabolic Cease and Reverse (SAR) indicator, as assessed on a every day chart, confirms this bullish outlook.

This indicator identifies potential pattern reversals and gives dynamic assist and resistance ranges. It locations dots above or under the worth chart: dots under the worth recommend a bullish pattern, whereas the dots above point out a bearish pattern.

As in ETH’s case, when the SAR rests under the worth, it indicators upward momentum and suggests a bullish pattern. If the bullish pattern persists, the ETH coin worth might breach resistance at $3,669 and climb towards its year-to-date excessive of $4,093.

Ethereum Worth Evaluation. Supply: TradingView

However, a decline in bullish stress will occasionthe ETH coin worth to fall towards assist shaped at $3,336.