Japan’s Yomiuri Shimbun reported Saturday that the Monetary Companies Company (FSA) is holding closed talks with “specialists” about cracking down on Bitcoin and crypto in Japan. Some residents are bullish on the information, as they hope for tax reduction through potential authorized amendments. Their hopes and skyrocketing centralized adoption in Japan hinge, partly, on the excitement that adopted Trump’s re-election in america.

Japan’s Yomiuri Shimbun reported early Saturday (JST) that the nation’s monetary regulator could also be shifting to crack down on crypto. In view of reining in unregistered peer-to-peer use (sarcastically, the entire level of Bitcoin within the first place), the Monetary Companies Company (FSA) is reportedly in closed-door talks with “specialists” about altering the authorized system in relation to digital property.

‘Unregistered’ crypto use focused as funding skyrockets in Japan

In gentle of the discussions, amendments could possibly be made to the Cost Companies Act and the Monetary Devices and Trade Act. The report notes that as centralized funding in crypto is “quickly growing” there’s a fly within the state’s soup: unregistered intermediaries and people buying and selling crypto with out Massive Bro’s permission.

To assist seize Satoshi’s pesky peer-to-peer creation bringing financial freedom to the plenty, the Japanese political machine is reportedly contemplating stiffer penalties for “unregistered” use, and requiring “crypto asset issuers to reveal particulars of their enterprise operations and shares.”

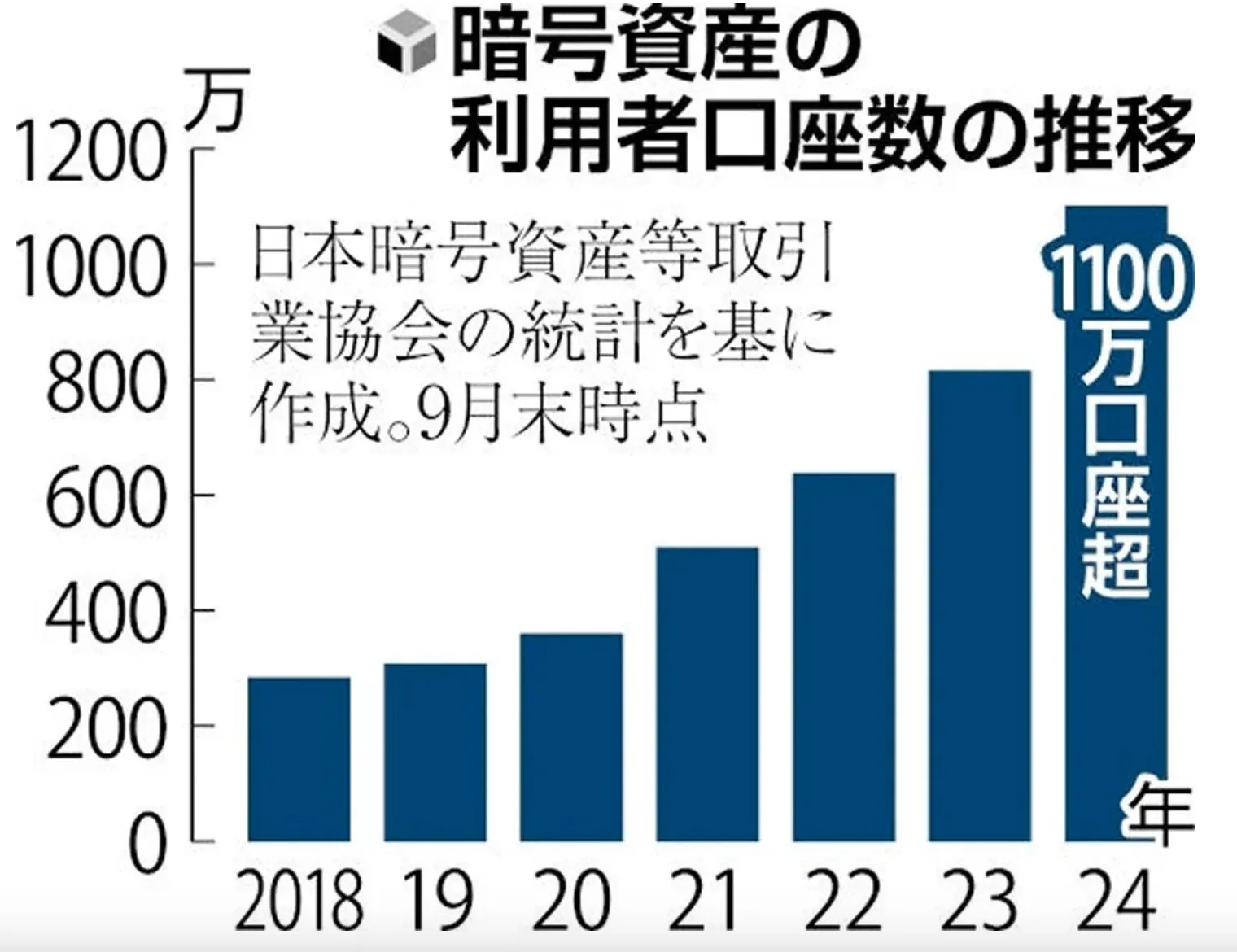

Crypto accounts opened in Japan have grown 3.5X during the last 5 years. Supply: Yomiuri Shimbun.

Public sentiment cut up with potential Bitcoin tax overhaul and spreading Trump mania

On the flip facet, some normie buyers appear fairly completely satisfied. One situation the Japanese public has their eyes on is reducing the nation’s astronomically excessive taxation of cryptocurrencies. As Cryptopolitan has beforehand reported, there was political discourse a few separate 20% tax fee for digital property. Presently, Bitcoin buyers in Japan might be taxed as excessive as 55% on their beneficial properties.

The Yomiuri report notes that the tax overhaul could also be a results of the key FSA talks, presumably as a result of stricter legal guidelines permitting crypto to be seen as a extra reliable asset class.

Nonetheless, the report could also be complicated for some. Simply this week, headlines within the nation have been selling the concept rules may very well turn into much less cumbersome for so-called intermediaries and different smaller companies concerned with crypto.

The rub? They’ll should be supervised by a registered trade to get pleasure from the advantages of proposed lightened restrictions for NFTs and in-game/particular currencies.

Additional coloring the overhaul situation is the Trump hype seeping into the psyche of buyers in Japan, who worry the nation could lag behind “crypto-friendly” regimes like they think about the U.S. to be. “Japan can now not afford to maintain a lid on Bitcoin,” one social media person famous on X, referencing Donald Trump. “Tax reform must be applied with an eye fixed towards selling its use.”

The Yomiuri Shimbun report talked about the truth that the U.S. President-elect promised to make America a “Bitcoin superpower,” and famous the launch of Bitcoin exchange-traded funds (ETFs). However advocates of permissionless peer-to-peer (P2P) use of crypto as described within the Bitcoin whitepaper and people who assume the Japanese state has higher issues to do than huff the flatulence of Musk and Mango Messiah, stay unimpressed.

“A foul premonition,” one other commenter tweeted.

The FSA plans to succeed in a call in regards to the matter inside fiscal 2024 yr, as per the report, and work with the Monetary System Council in 2025 if stronger rules are deemed obligatory.

Land a Excessive-Paying Web3 Job in 90 Days: The Final Roadmap