XRP stays some of the talked-about digital belongings within the crypto market, with rising hypothesis round its future value potential.

Buyers accumulating 1,000 to 10,000 XRP right now could possibly be positioning themselves for vital features if main catalysts materialize.

Two key narratives may drive XRP’s value to unprecedented heights. The primary is its potential inclusion in a U.S. digital asset reserve, whereas the opposite is the approval of an XRP exchange-traded fund (ETF).

Each situations contain large-scale institutional adoption, which may set off exponential value appreciation.

XRP as a US Reserve Asset—A Debt Answer?

One of the bold speculations round XRP is its potential adoption as a part of a U.S. digital asset reserve.

Ripple has been actively participating with policymakers. Specifically, CEO Brad Garlinghouse has mentioned blockchain’s position within the monetary system with U.S. leaders, together with President Donald Trump.

If the U.S. authorities had been to leverage Ripple’s 37.7 billion escrowed XRP for nationwide monetary methods, some consider it may assist offset the nationwide debt, which at the moment stands at $36 trillion.

Nevertheless, at XRP’s present value of $2.58, Ripple’s escrow holdings are value solely $97.26 billion. That is removed from making a significant impression on the debt.

For XRP to single-handedly get rid of the U.S. nationwide debt, its value would want to rise dramatically.

Particularly, to match the $36 trillion debt determine, XRP’s value must surge to $955 per token. This could mark a staggering 36,911% enhance from right now’s ranges.

Whereas such an final result is extremely speculative, it highlights the sort of valuation XRP may obtain if it turns into a core monetary asset for the U.S. authorities.

XRP ETF Approval—How Excessive Can It Go?

Even when XRP doesn’t change into a reserve asset, one other main catalyst may propel its value: the approval of an XRP ETF. Bitcoin’s ETF approvals in 2024 triggered huge inflows, with over $35 billion pouring into the market.

If XRP ETFs seize simply 50% of Bitcoin ETF inflows, that will translate to a $17 billion capital injection. Making use of a conservative 1:10 inflow-to-market cap multiplier, XRP’s complete valuation would rise by $170 billion.

XRP’s present market cap of $150 billion would deliver its complete valuation to roughly $235 billion. With a circulating provide of 57.7 billion tokens, this new valuation would push XRP’s value to $5.54 per token—a 115% enhance from right now’s value of $2.58.

Why Holding 1,000 to 10,000 XRP May Be Life-Altering

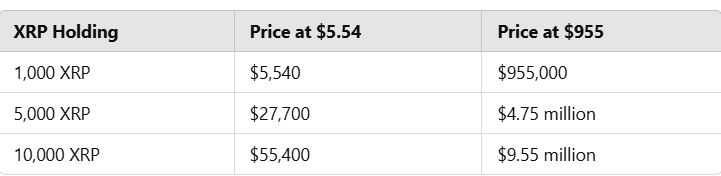

For traders accumulating XRP now, these value situations symbolize vital upside potential. Right here’s how totally different holdings would translate if XRP reaches these targets:

XRP value illustrations

Even within the extra conservative ETF-driven situation, a 1,000 XRP funding right now ($2,580) may flip into $5,540. If XRP had been ever to achieve $955 as a reserve asset, a ten,000 XRP holding could possibly be value an astonishing $9.55 million.

Whereas these projections are attractive, they continue to be speculative, and there’s no assure any of the projected illustrations may materialize.