In 2025, international economies are faltering. As markets — together with crypto — react to Trump’s tariffs, there’s one query on the minds of many buyers. Will Bitcoin hold going up from these ranges, or are we coming into a deeper correction? With one other potential crypto bull run on the brink and rising curiosity from institutional buyers, now’s the time to chop the noise and study market traits. Right here’s what to know.

On this information

- How excessive will Bitcoin go?

- What does all this imply for you?

- Bitcoin’s historic worth peaks

- Key elements that may form Bitcoin’s worth subsequent

- On-chain evaluation and market sentiment

- Monitoring the knowledgeable worth predictions

- What might cease Bitcoin from reaching new highs?

- So, will Bitcoin hold going up?

- Regularly requested questions

How excessive will Bitcoin go?

Everybody’s asking the identical factor proper now: how excessive will Bitcoin go from right here? You’ve in all probability seen daring predictions floating round — some saying Bitcoin might hit $100K, others throwing round numbers like $250,000, or much more. However what’s actual, and what’s simply hype? The reality is, there’s a little bit of each.

Some well-known voices within the area — like Tom Lee from Fundstrat — are tremendous bullish. He thinks BTC might attain $250,000 by the top of this cycle, pushed by stronger demand from institutional buyers in crypto and cleaner regulation.

Even Robert Kiyosaki (sure, the Wealthy Dad Poor Dad man) is on the identical prepare, betting on Bitcoin to go that top, particularly if governments begin stacking it as a reserve asset.

Bitcoin predictions: Polymarket

On the flip aspect, platforms like Polymarket are slightly extra measured, projecting Bitcoin to land someplace round $120K–$138K by the top of 2025.

After all, there are some apprehensive or reasonably downright pessimistic takes flying round too. Some analysts warn that Bitcoin’s worth might nonetheless dip, particularly if international uncertainty sticks round. Mike McGlone from Bloomberg is certainly one of them. He even flagged a attainable drop to $10K if issues unravel; although that’s positively the worst-case type of discuss.

What does all this imply for you?

Principally, there’s no single reply. However the mixture of rising adoption, potential provide shocks, and robust demand means that the upside potential continues to be in play — even when it’s not a straight line to the highest.

To actually get a deal with on the place Bitcoin might go subsequent, it helps to look again. Historical past has a humorous manner of repeating itself, particularly in crypto. Let’s now see what meaning.

Bitcoin’s historic worth peaks

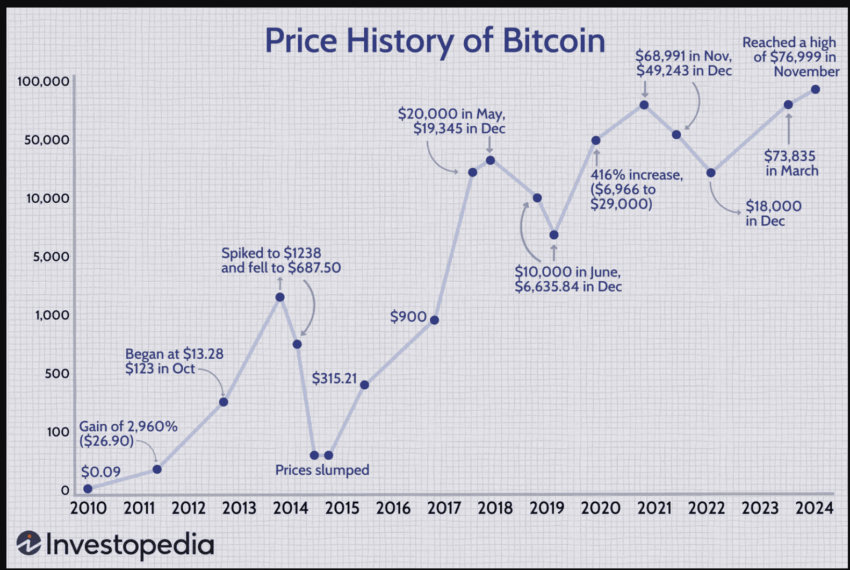

The OG cryptocurrency has skilled important worth surges over time. Right here’s a concise overview of those peaks:

2013: The primary main surge

In November 2013, Bitcoin reached a worth of $1,242. This surge was pushed by elevated media consideration and rising curiosity from early adopters.

2017: Breaking the $20,000 degree

December 2017 noticed Bitcoin soar to almost $20,000. This exceptional rise was pushed by mainstream adoption and heightened investor enthusiasm.

Bitcoin worth peaks: Investopedia

2021: Reaching new heights

By April 2021, Bitcoin peaked at $64,895. This transfer was pushed by institutional investments and widespread recognition as a digital asset. Do be aware that one other peak — nearly $69,000 — adopted a couple of months later.

2024: Surpassing the $100,000 milestone

In November 2024, Bitcoin surpassed the $100,000 mark for the primary time. Nonetheless, it didn’t hold surging, as an alternative going through huge price-related resistance.

These historic peaks reveal Bitcoin’s volatility however most notably its potential for substantial development. Analyzing these traits can gives insights into the elements that drive worth actions and assist us formulate knowledgeable Bitcoin worth predictions.

Key elements that may form Bitcoin’s worth subsequent

So now that we’ve checked out how Bitcoin has carried out previously, what’s subsequent? What really strikes the needle in terms of Bitcoin’s worth?

Bitcoin halving and the availability shock impact

One of many greatest forces behind each main crypto bull run is the Bitcoin halving. This occasion cuts the variety of new BTC coming into circulation in half, and occurs each 4 years.

It issues merely due to provide and demand. When fewer cash are being created, however folks nonetheless need in (particularly with extra institutional buyers in crypto), the value usually spikes. Traditionally, worth rallies have adopted every halving, and with the most recent one behind us, the stage may already be set.

Institutional adoption is (nonetheless) a giant deal

Institutional adoption is (nonetheless) a giant deal

In case you assume it’s simply retail buyers shopping for in — assume once more. Huge names like BlackRock, Constancy, and even sovereign wealth funds have dipped their toes into Bitcoin through ETFs, custody companies, and spot allocations. This isn’t nearly hype. tI’s capital, credibility, and long-term conviction.

The extra these gamers accumulate, the tighter the availability turns into for everybody else. That’s why many consider the subsequent leg up available in the market will probably be pushed by huge cash — not simply retail FOMO.

Macroeconomic elements are taking part in a much bigger function

Then there’s the larger image. We’re speaking rates of interest, inflation, fiat devaluation; the entire macro mess. When conventional belongings look shaky, Bitcoin begins to seem like a hedge. In occasions of uncertainty, many see it as “digital gold” — a retailer of worth that sits exterior the normal system.

Throughout the 2021–2022 inflation spike, Bitcoin was seen as a hedge and climbed quickly. However as central banks hiked rates of interest, threat belongings took successful, together with crypto.

On-chain evaluation and market sentiment

Making sense of Bitcoin’s worth dynamics requires extra than simply monitoring market information. It additionally includes analyzing on-chain knowledge, which may supply essential insights into investor habits and market sentiment. Let’s take a look at a couple of key metrics:

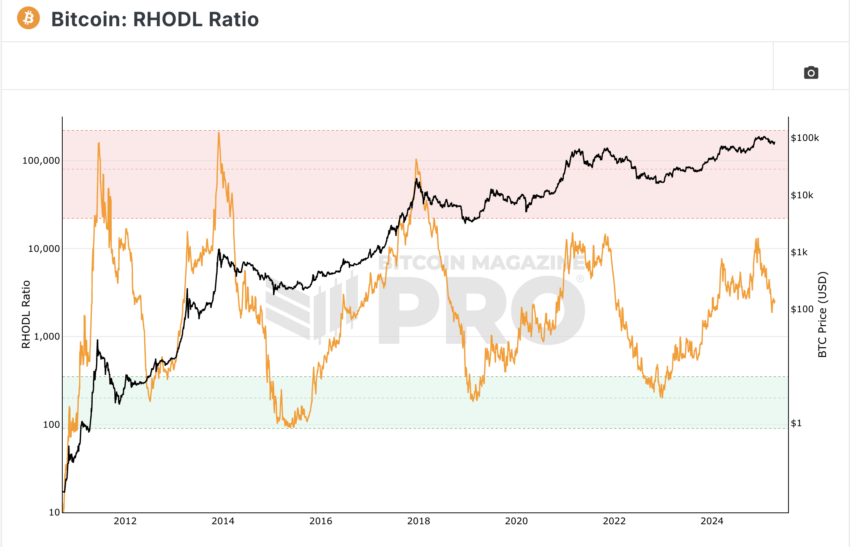

1. HODL ratio and long-term holder habits

The HODL ratio displays the proportion of Bitcoin held long-term versus short-term. Traditionally, a excessive HODL ratio signifies sturdy conviction amongst buyers, usually previous worth surges. As an example, in early 2020, a rising HODL ratio corresponded with Bitcoin’s ascent from round $7,000 to over $60,000 by April 2021.

Bitcoin RHODL and worth: Bitcoin Journal Professional

2. Whale accumulation patterns

Giant holders, or “whales,” considerably influence Bitcoin’s worth. Current knowledge exhibits that whales have collected over 100,000 BTC since early March 2025, signaling confidence in Bitcoin’s long-term worth. Such accumulation usually precedes bullish market traits.

Whale motion: Cryptoquant

3. Change reserve ranges

Monitoring Bitcoin reserves on exchanges offers perception into potential promoting strain. A lower in change reserves means that buyers are shifting their holdings to chilly storage, indicating a bullish sentiment. Conversely, growing reserves could sign potential sell-offs.

Bitcoin worth motion and change reserves: Cryptoquant

4. Market sentiment indicators

Instruments just like the Worry & Greed Index gauge investor sentiment. Excessive concern can point out a shopping for alternative, whereas excessive greed could sign a market correction. In March 2025, the index reached a “greed” degree of 75, aligning with Bitcoin’s worth nearing $100,000.

Worry and greed index: CoinMarketCap

These on-chain metrics present beneficial insights into market dynamics, complementing conventional technical and basic analyses.

Monitoring the knowledgeable worth predictions

So, will Bitcoin hold going up? Varied specialists have weighed in with their forecasts:

- PlanB’s Inventory-to-Circulation mannequin: This mannequin, which assesses Bitcoin’s shortage by evaluating its circulating provide to the speed of recent provide, means that Bitcoin might attain $288,000 by 2025, pushed by its restricted provide and growing adoption.

- Tim Draper: The enterprise capitalist predicts Bitcoin will hit $250,000 by 2025, citing elevated adoption by retailers, institutional buyers, and governments.

- Cathie Wooden of ARK Make investments: Forecasts Bitcoin reaching $500,000 or extra by 2025, pushed by institutional adoption and the asset’s function as a hedge in opposition to inflation.

- Anthony Scaramucci: The founding father of SkyBridge Capital predicts Bitcoin might attain $200,000 in 2025, led by elevated institutional adoption.

- H.C. Wainwright Analysts: They venture Bitcoin’s worth might surge to $225,000 by the top of 2025, citing historic worth cycles and favorable regulatory expectations.

What might cease Bitcoin from reaching new highs?

What might cease Bitcoin from reaching new highs?

Whereas worth targets sound thrilling — $100K, $250K, even $500K — the trail up isn’t all the time clear. For each bullish cycle, there are headwinds that might derail the momentum.

Right here’s what might gradual Bitcoin down, or at the least make the street to a brand new BTC all-time excessive extra bumpy:

Regulatory uncertainty

Governments nonetheless haven’t totally found out learn how to regulate crypto. Each time there’s discuss of banning self-custody, taxing unrealized features, or proscribing stablecoins, the market reacts.

- In early 2022, regulatory concern within the U.S. shaved practically 25% off Bitcoin’s worth in simply two weeks.

- Any new restrictive insurance policies might spook each retail and institutional buyers in crypto, stalling momentum.

Macroeconomic instability

Whereas we’ve talked about that BTC can considerably act as a hedge, it’s not fairly there but.

- If central banks increase rates of interest once more or liquidity dries up, threat belongings (together with crypto) are inclined to unload.

- Throughout 2022–2023, Bitcoin fell from $69K to $16K as fee hikes and recession fears shook investor confidence.

Overheated market and greed cycles

Generally it’s not the information — it’s us. The crypto bull run hype cycle can push valuations into unsustainable territory.

- Keep in mind the Worry & Greed Index? When it crosses into “excessive greed” (above 80), native tops usually observe.

- In late 2021, the index hit 95 simply earlier than Bitcoin dropped by over 40% in three months.

Inside shocks or safety points

Whereas Bitcoin’s core community is safe, the broader crypto ecosystem isn’t bulletproof.

- Change hacks, just like the FTX collapse in 2022, worn out billions and tanked market confidence.

- Protocol bugs, mining assaults, or pockets exploits might create panic, even when BTC itself stays safe.

So, will Bitcoin hold going up?

With sturdy market traits, rising institutional adoption, and post-halving momentum, the long-term outlook nonetheless leans bullish. Whereas short-term dips could check your nerves, historical past, on-chain knowledge, and provide dynamics counsel that BTC isn’t executed but. All indicators point out that Bitcoin will hold going up. Nonetheless, in crypto nothing is assured, and we are able to actually count on numerous twists and turns alongside the best way.