India’s economic system is juggling two realities: a sluggish manufacturing sector and booming development in providers and crypto.

November’s numbers are out, and so they inform a narrative of highs and lows that replicate the nation’s advanced financial state of affairs. Manufacturing slowed, providers soared, and crypto continues to dominate regardless of regulatory crackdowns and heavy taxation.

The manufacturing buying managers’ index (PMI) fell barely to 57.3 from October’s 57.5. In distinction, the providers index rose to 59.2 from 58.5, in keeping with preliminary knowledge from HSBC Holdings. Collectively, they nudged the composite index as much as 59.5, a minor enhance from 59.1.

A PMI above 50 means development, beneath meaning contraction. So, whereas manufacturing softened, the providers sector carried the load, reaching its highest employment index since December 2005, because of sturdy demand and higher enterprise circumstances.

Manufacturing slows, inflation bites

Regardless that the manufacturing sector slowed, HSBC’s Chief India Economist, Pranjul Bhandari, mentioned it “managed to outperform expectations.” However rising prices are biting onerous.

Producers face larger uncooked materials costs, whereas meals and wages are driving up inflation within the providers sector. Consequently, personal firms raised their costs once more in November, passing the fee onto shoppers.

City spending is slowing, too, including to the gloom. Economists have adjusted their GDP development forecasts for the 12 months ending March 2025.

Goldman Sachs now predicts 6.4% development, a notable downgrade that displays these challenges. Regardless of this, the providers sector is a vibrant spot, powered by resilient demand and companies trying to scale up.

Crypto thrives regardless of powerful guidelines

India’s crypto scene doesn’t care a lot for slowdowns. It’s thriving, even beneath a number of the world’s strictest rules. The nation has a 30% tax on crypto good points and a 1% tax on each transaction, often called a tax deducted at supply (TDS).

These insurance policies have pushed some traders to worldwide exchanges with friendlier guidelines, however India nonetheless leads the world in crypto adoption. It ranks first on the International Crypto Adoption Index and second within the Central and South Asia area for whole crypto worth acquired.

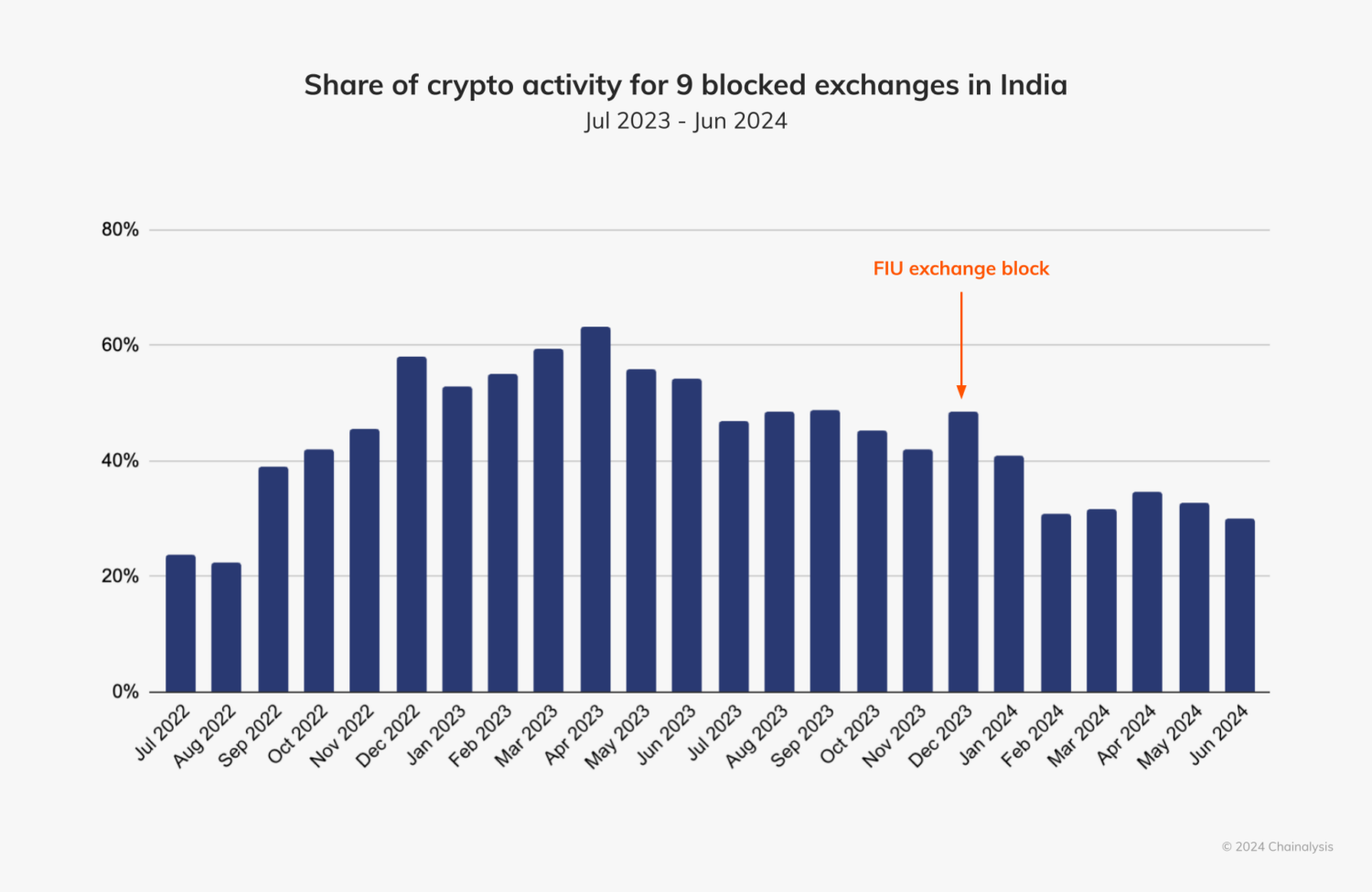

Share of crypto exercise for 9 blocked exchanges in India. (Supply: Chainalysis)

In December 2023, India’s Monetary Intelligence Unit (FIU) cracked down on 9 offshore exchanges, together with Binance, Kraken, and KuCoin, for not complying with anti-money laundering legal guidelines.

The FIU requested the Ministry of Electronics and Data Expertise (MeitY) to dam the URLs of those exchanges for Indian customers.

Nonetheless, this block wasn’t as efficient as supposed. Customers who had already downloaded these apps may nonetheless entry them, and a few platforms remained out there for brand spanking new downloads.

From Zero to Web3 Professional: Your 90-Day Profession Launch Plan