Ethereum’s (ETH) current value struggles haven’t stopped establishments from accumulating cash, with main entities transferring important holdings from exchanges. The second-largest cryptocurrency by market capitalization has gone up by 0.3% since rebounding from current lows and reclaiming the $2,650 stage.

On-chain information from Lookonchain revealed that previously two days, Cumberland, a crypto asset administration agency, withdrew 62,381 ETH (value roughly $174 million) from exchanges and transferred it to Coinbase Prime.

It appears that evidently establishments are accumulating $ETH.

Up to now 2 days, #Cumberland withdrew 62,381 $ETH($174M) from exchanges and transferred it to #CoinbasePrime.https://t.co/AT53HHa36m pic.twitter.com/6NJxnKxjZH

— Lookonchain (@lookonchain) February 6, 2025

The information comes simply two days after BlackRock, the world’s largest asset supervisor, bought 100,535 ETH valued at $276 million, taking their complete holdings to 1,352,934 ETH, value roughly $3.71 billion, based on Lookonchain’s February 5 X replace.

Arkham Intelligence information exhibits that after its newest ETH transaction, Cumberland is managing over $31 million in crypto belongings, which embody AAVE, USDC, AVAX, USDT, and.

Ethereum outflows from exchanges gasoline value restoration

Ethereum’s current value motion follows a interval of intense market volatility that noticed its value drop to as little as $2,120. Consumers stepped in aggressively at that stage, resulting in a robust restoration. The rally gathered momentum after ETH broke via key resistance ranges at $2,550 and $2,650, and as of the time of this publication, the coin is altering fingers above $2,800.

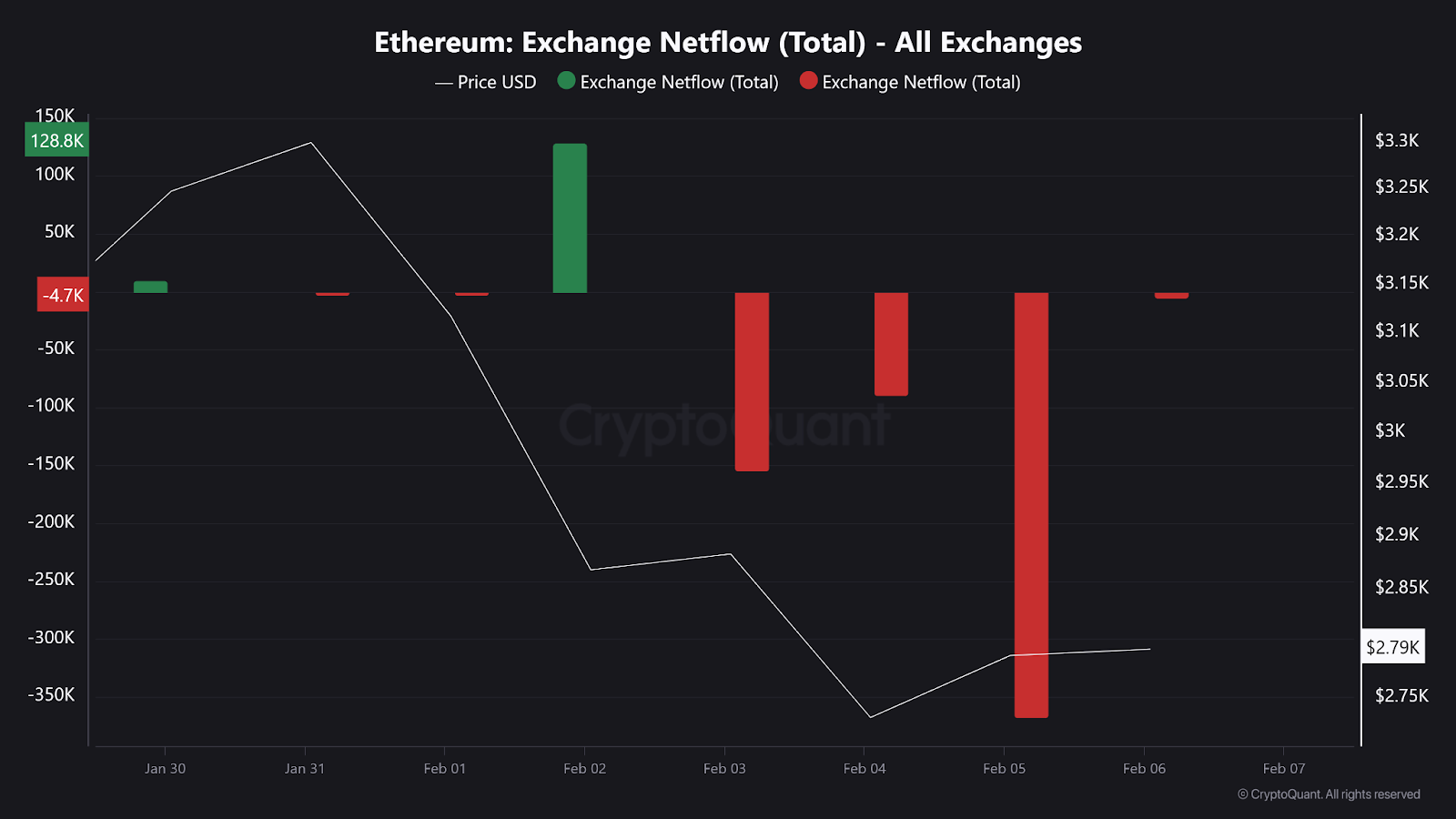

Data from CryptoQuant present that Ethe’s netflow, which tracks the full inflows and outflows from buying and selling platforms, noticed 367.6 ETH (roughly $992,000) transfer from exchanges on Wednesday.

Ethereum 7-day netflow from exchanges. Supply: CryptoQuant

There have been three consecutive days of cumulative destructive netflow recordings, signaling a rising confidence amongst buyers of an incoming value rally.

Kraken change was the most important contributor to the outflows, garnering about 299 ETH, representing over 80% of the full.

CryptoQuant contributor Amr Taha famous on Wednesday that Ethereum’s change netflow on spinoff exchanges has fallen beneath -300,000 ETH for the primary time since August 2023. This implies merchants are transferring massive quantities of ETH off exchanges, decreasing promote strain.

Bitcoin change outflows proceed

Bitcoin additionally skilled the identical market sentiment, with centralized exchanges registering a internet outflow of over 17,000 BTC, valued at roughly $1.6 billion based mostly on Bitcoin’s market value of $98,600.

In keeping with information from Glassnode, this marked the most important single-day outflow of BTC since April 2024.

Just like Ethereum, change information from CryptoQuant additional exhibits that each one main crypto buying and selling platforms recorded a complete destructive internet circulation of 47,000 BTC yesterday. Of that, 15,800 BTC was attributed to Coinbase alone.

Coinbase cut up 4 addresses totaling 20,949 BTC, into 60 Addresses: 20 x 245 BTC and 40 x 401 BTC

appears like one thing is cooking, attainable main purchases this week by ETFs or MSTR https://t.co/br8iMlnyaD— Sani | TimechainIndex.com (@SaniExp) February 5, 2025

Giant buyers sometimes withdraw Bitcoin from exchanges after they plan to carry it for the long run, which the market considers a bullish sign.

Cryptopolitan Academy: Are You Making These Web3 Resume Errors? – Discover Out Right here