Bitcoin reveals bullish momentum because it breaks key resistance, with value targets doubtlessly reaching $107k this week.

Bitcoin is beginning the week on a bullish be aware with an intraday rise of 0.70%. With the intraday rise, Bitcoin is making a bullish candle after creating 4 consecutive each day Doji candles.

With the restoration gaining momentum, a short-term breakout within the BTC value development hints at a possible comeback this week. Will this restoration lead to a Bitcoin value surge past $100,000? Let’s discover out.

Bitcoin Bullish Reversal at $95k Breaks Key Resistance

Within the 4-hour value chart, Bitcoin reveals a powerful reversal from the $95,000 mark. The bullish comeback is strengthening as Bitcoin breaks previous the native resistance development line. Moreover, the uptrend exceeds the 38.20% Fibonacci stage.

At present, Bitcoin is obtainable at a market value of $97,399. With three consecutive bullish candles and vital cheaper price projections, Bitcoin is marking a double-bottom reversal. Moreover, the trendline breakout marks a key bullish occasion for Bitcoin.

The restoration run in Bitcoin is steadily gaining energy because the TSI common traces are recovering inside the unfavourable territory. Moreover, because the TSI traces strategy the zero line in a optimistic alignment, the indicator helps the possibilities of a bullish development.

Key Shopping for Alternative

Supporting the possibilities of a bullish comeback, Ali Martinez has highlighted a shopping for alternative in Bitcoin. In his current X put up, the analyst identified that the TD Sequential Indicator, completely timed on the Bitcoin each day chart, is now flashing a purchase sign.

This hints at a possible backside in BTC costs and will increase the possibilities of a reversal rally.

Derivatives Market: Bullish Speculations Rise

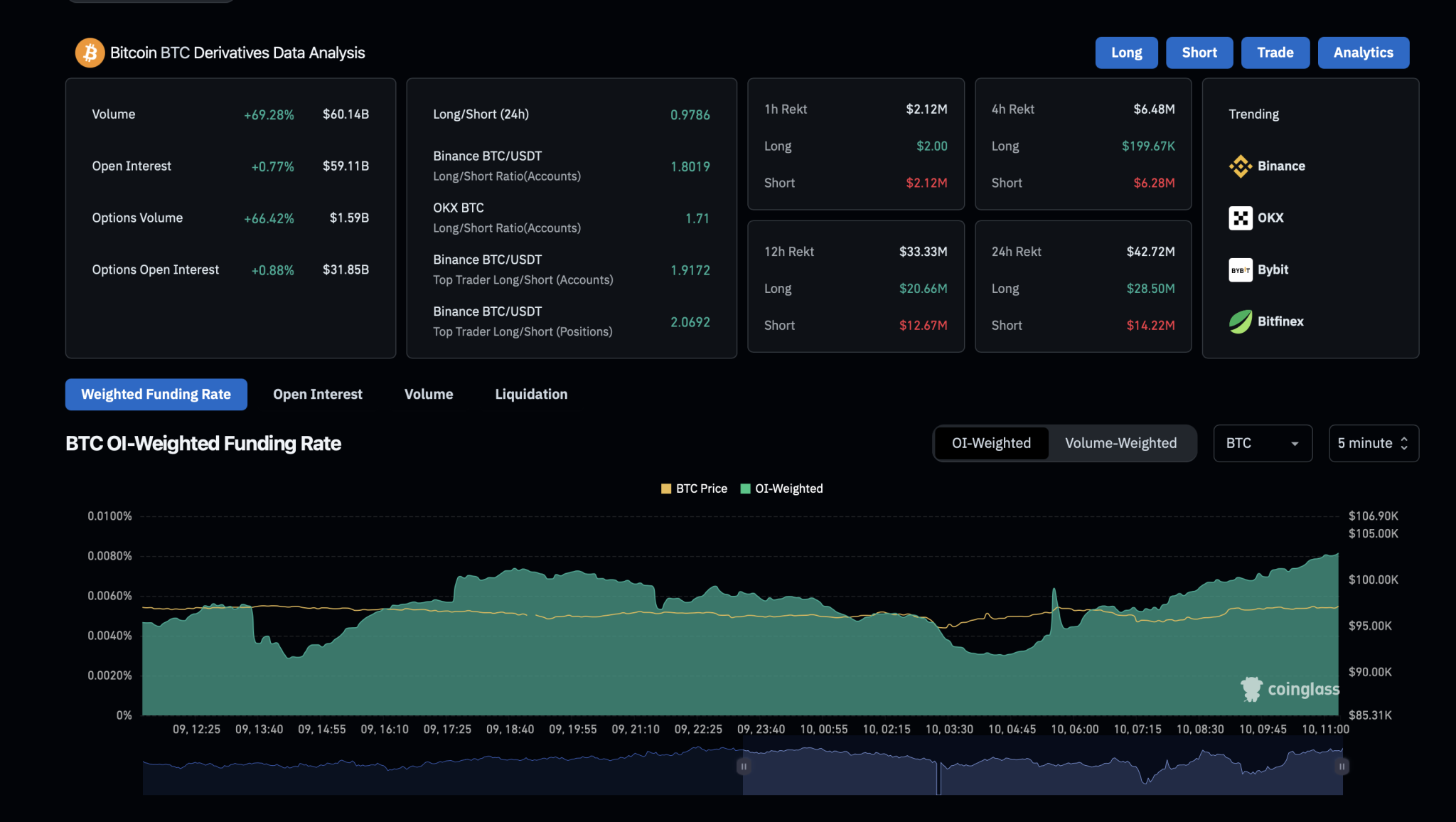

Within the derivatives market, bullish speculations have elevated considerably. Bitcoin’s open curiosity over the previous 24 hours has risen by 0.77% to $59.11 billion.

BTC Open Curiosity

Extra considerably, the funding charge has seen a notable enhance. From a backside of 0.003%, funding charges have now climbed to 0.0081%. This displays the willingness of consumers to carry on to lengthy positions in Bitcoin.

Moreover, Bitcoin’s long-to-short ratio has grown considerably over the previous 24 hours. At present, the Bitcoin long-to-short ratio stands at 0.9992, with lengthy positions at 49.98% and brief positions at 50.02%.

Regardless of the almost equal distribution of lengthy and brief positions, the optimistic funding charges and growing open curiosity point out a usually bullish sentiment within the derivatives market.

BTC Value Targets Prolong to $107K This Week

Because the chance of a bullish restoration grows, Fibonacci ranges point out a key resistance on the 61.80% stage, similar to $100,557, simply above the psychological $100,000 mark. If the uptrend continues, Bitcoin might check the $107,000 provide zone this week.

However, assist on the 23.6% Fibonacci stage, round $94,595, is anticipated to carry Bitcoin’s value above this stage within the occasion of a pullback.