Ethereum (ETH) misplaced its three-year help towards Bitcoin (BTC) as essentially the most distinguished cryptocurrency rallied in direction of its $100,000 goal on Friday, November 22. ETH has confronted sticky resistance at $3,500 for almost 4 months whereas opponents hit report highs this cycle.

Desk of Contents

Ethereum loses favour with institutional buyers, ETF efficiency lacklustre

Ethereum slipped to a low of 0.03187 towards Bitcoin on Friday, November 22. As Bitcoin made its approach in direction of the $100,000 goal, Ethereum value dropped below the help degree that was maintained for almost three years since 2021.

Ethereum’s decline towards Bitcoin is probably going a end result of a number of components, together with an absence of curiosity from institutional buyers, a gentle decline in curiosity from retail buyers, and the shift of capital and a spotlight to Layer 2 and Layer 3 scaling initiatives, amongst others.

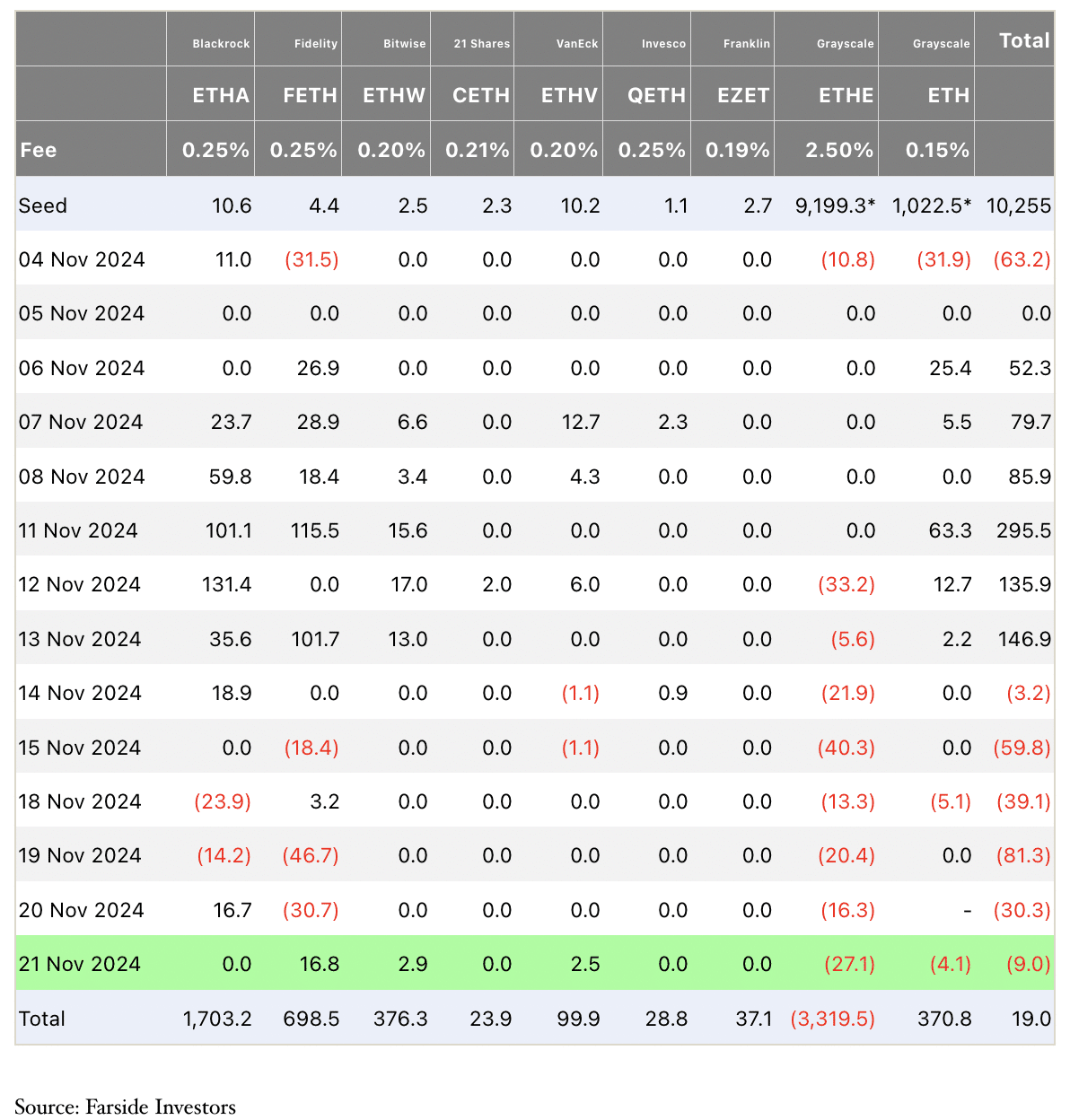

The efficiency of the Ethereum Spot ETF explains how the altcoin has did not garner funding from establishments whereas Bitcoin Spot ETF continues to outperform.

Knowledge from Farside Buyers UK reveals that ETH ETFs have famous web detrimental flows or outflows for the previous six days. In distinction, Bitcoin Spot ETFs proceed to draw billions of {dollars} in institutional fund flows.

Ethereum ETF flows | Supply: Farside Buyers

Tuur Demeester, Editor-in-Chief of Adamant Analysis, informed Forbes that Ethereum is likely to be “dying a gradual dying,” signalling the shift in market dynamics and the slowdown in institutional adoptions.

You may additionally like: Bitcoin nears $100K whereas retail buyers dominate market

Solana challenges Ethereum’s dominance, on-chain evaluation

Whereas Ethereum ETF efficiency struggles, the altcoin faces a problem from its competitor, Solana (SOL). Solana’s market capitalization acquire and value rally pushed SOL to the highest 4 cryptocurrencies, per CoinGecko.

Prime cryptocurrencies by market capitalization | Supply: Coingecko

Solana dominates Ethereum when it comes to transaction quantity throughout decentralized alternate platforms, DEX exercise and protocol charges generated in October 2024 and November 2024.

Whereas Ethereum’s value has climbed on Thursday and Friday this week, the altcoin struggles with resistance at $3,500, and a failure to interrupt previous this degree may problem the probability of additional features within the token.

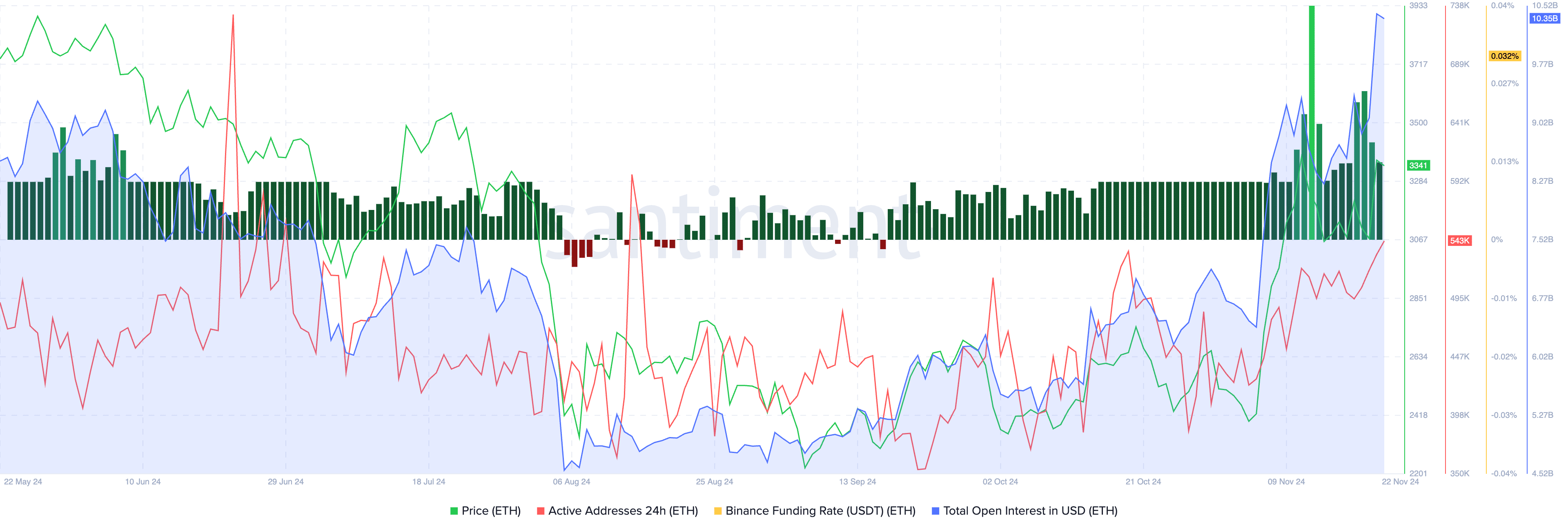

On-chain metrics are inconclusive. Whereas lively addresses stay properly beneath mid-August 2024 ranges, the funding fee on Binance has been persistently optimistic since mid-September 2024.

Open curiosity in Ethereum futures, a metric that gauges curiosity and demand amongst derivatives merchants, climbed to $10.35 billion, per Santiment knowledge. Statistics from derivatives markets help a bullish thesis for the altcoin. Mixed with the current enhance in Ether value, additional features are possible if the altcoin efficiently breaches resistance at $3,500.

Ethereum value vs. lively addresses, binance funding fee, whole open curiosity in USD | Supply: Santiment

Learn extra: Can Solana flip Ethereum? Discover out what’s at stake in your crypto holdings

Bitcoin leads cryptos with digital gold narrative

Ethereum is the second largest altcoin, and for the higher a part of the final decade, the 2 cryptocurrencies have been spoken of collectively by analysts and merchants. Nevertheless, Bitcoin has stepped into the function of “digital gold”, or a token used to hedge towards geopolitical crises and unpredictable occasions available in the market. On the similar time, Ethereum is confronted with scalability points.

Ethereum’s scalability points gave solution to the Layer 2 and Layer 3 protocols, and their tokens have yielded features for merchants in 2024. Nevertheless, the bottom chain is slowly shedding its attraction and traction amongst market members.

The digital gold narrative drew institutional consideration from nations that deemed it match so as to add Bitcoin to their stability sheet, whereas Ethereum continues to be engaged on its promise of being a “decentralized pc” to the world.

Whereas Ethereum has a bigger market capitalization than Financial institution of America, as of November 22, the altcoin is but to witness features within the present market cycle relative to meme cash and different cryptocurrencies like Solana.

Ethereum future expectations and technical evaluation

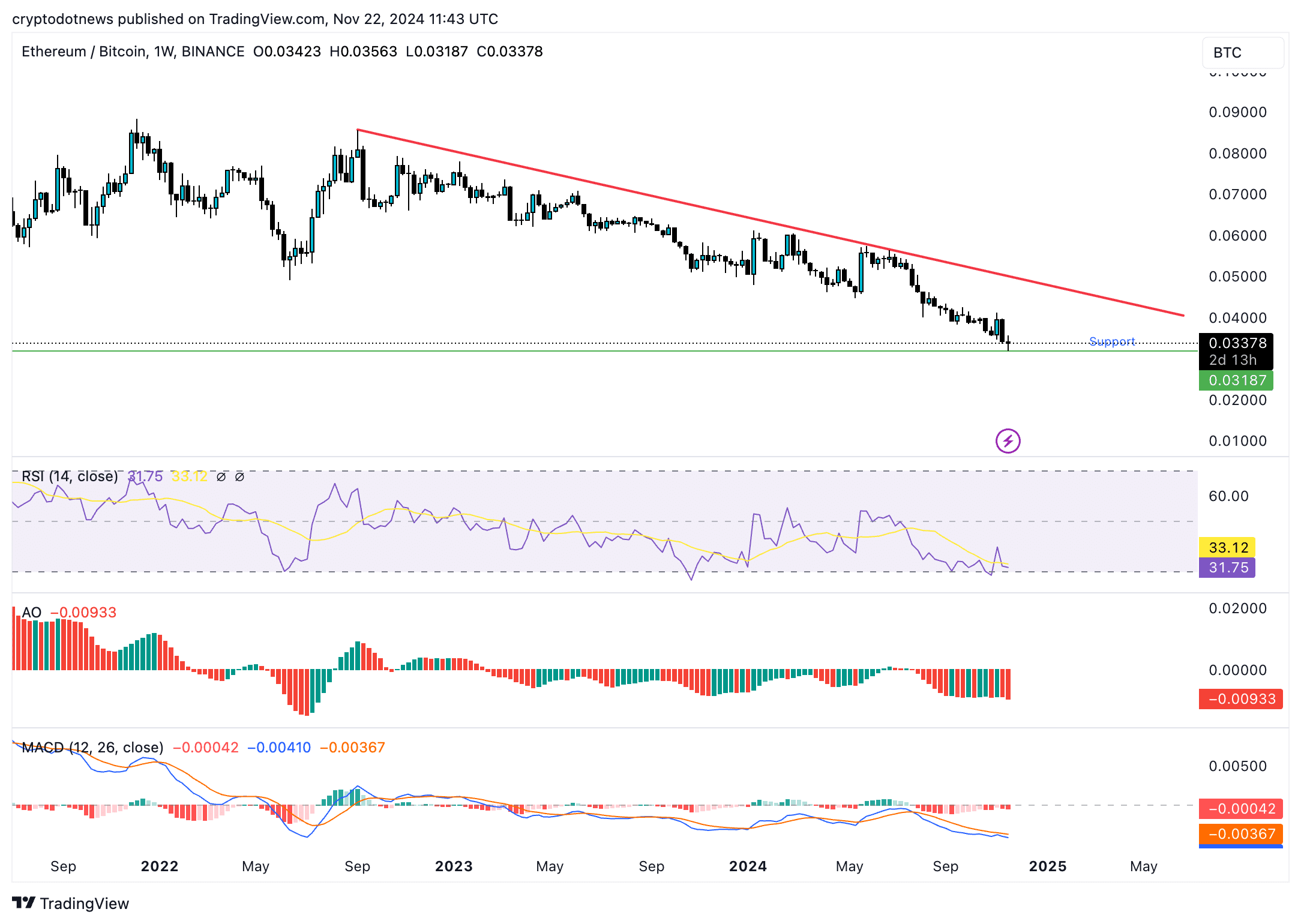

ETH/BTC slipped to a close to three-year low, all the way down to a essential help degree, as seen within the chart beneath. The decline is critical, and the pair has been trending downward since September of 2023.

Technical indicators like relative energy index and momentum indicators help a bearish thesis. RSI is 31, near the “oversold” zone below 30. This sometimes generates a purchase sign for merchants, that means that the asset is undervalued and is an efficient time to purchase for sidelined merchants.

Failure to recuperate from the help degree may result in an extra decline within the pair, with ETH/BTC slipping decrease within the subsequent few weeks of 2024.

ETH/BTC weekly value chart | Supply: Crypto.information

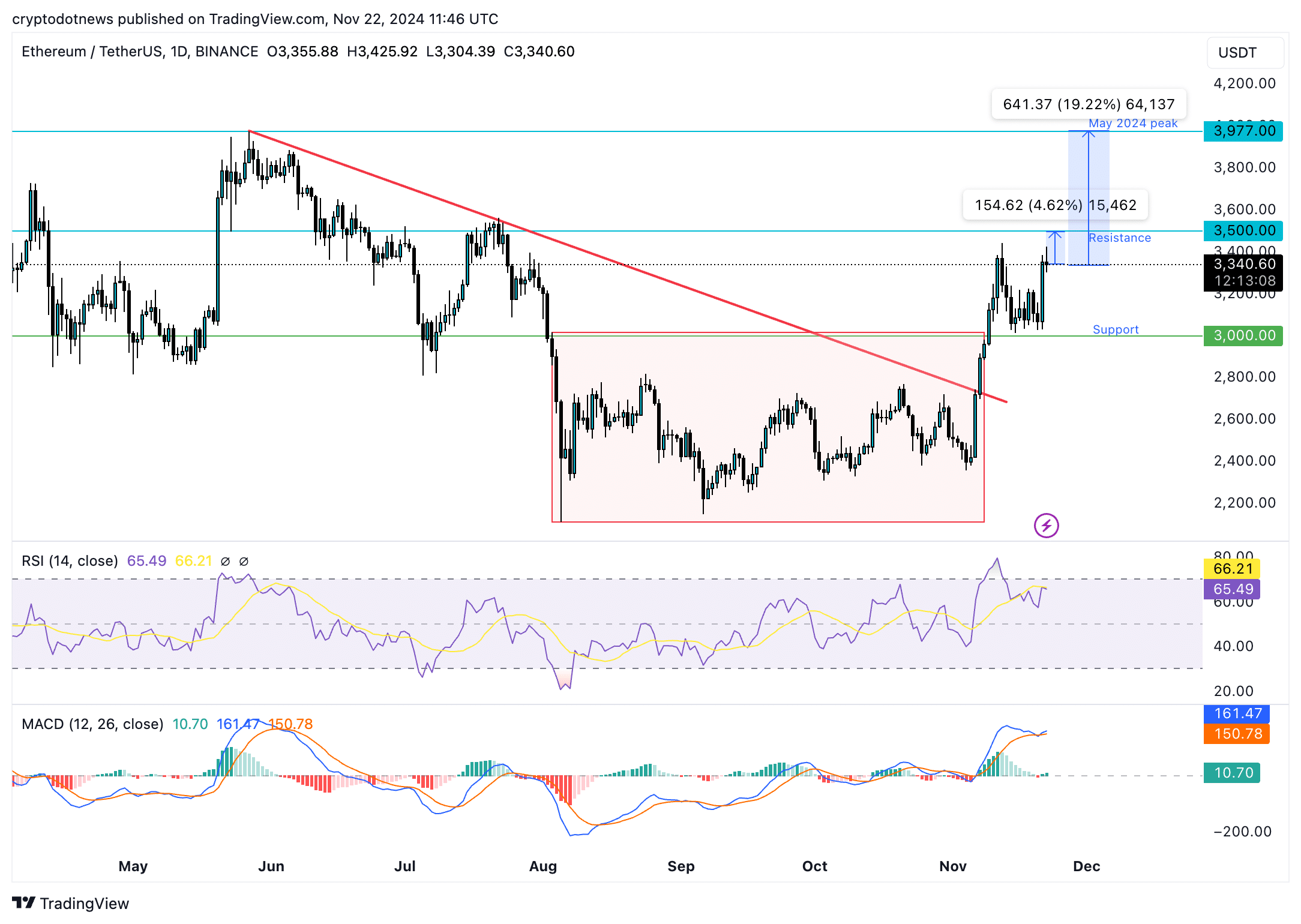

The ETH/USDT each day value chart reveals optimistic indicators for the altcoin. ETH value may observe features and rally in direction of the $3,500 resistance and the Could 2024 peak of $3,977 if the altcoin maintains its upward momentum.

Ethereum is lower than 5% away from the $3,500, and almost 20% features may ship ETH to check the $3,977 Could 2024 peak. RSI is 65, properly beneath the overvalued degree above 70. The inexperienced histogram bars on the transferring common convergence divergence indicator help a probability of additional features in Ethereum.

Ethereum’s underlying value pattern is optimistic, and if the altcoin maintains its regular climb, the $4,000, a psychologically necessary value degree, might be breached within the quick time period.

ETH/USDT each day value chart | Supply: Crypto.information

A correction may ship Ethereum to check help at $3,000, a key help degree for the altcoin all through 2024. Additional decline would imply Ethereum finds help on the decrease boundary of the vary at $2,111, as seen on the each day value chart.

Strategic concerns

Ethereum enjoys a robust correlation with Bitcoin, at 0.91, based on Macroaxis.com. This means {that a} important spike in Bitcoin value might be adopted by features in Ethereum and the altcoin’s value is anticipated to watch a optimistic influence.

Whereas Ethereum lags in comparison with its friends, a correction in Bitcoin may add to the challenges confronted by the altcoin in its uphill battle with resistance at $3,500. Merchants want to observe the amount of choices and open curiosity in Ethereum earlier than including to their positions in ETH.

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.