Michael Saylor promised Microsoft’s board of executives to current Bitcoin benefits for the corporate in simply 3 minutes, and he did.

Govt Chairman of MicroStrategy, Michael Saylor, offered Bitcoin strategic reserve for Microsoft (MSFT) boards on Dec. 01 as he promised earlier. He highlighted that Bitcoin is a change of digital capital, and they should undertake Bitcoin as a part of their steadiness sheet within the subsequent few years.

Bitcoin is projected to be one of many greatest belongings on the earth and account for $280 trillion of world wealth, which exceeds gold and artwork by the subsequent 20 years with $45 trillion and $110 trillion, respectively.

Saylor additionally famous that Microsoft clearly wanted to be powered by digital capital as the value motion of Bitcoin outperformed Microsoft shares by 12 instances yearly. MicroStrategy (MSTR) shares additionally jumped to three,045% after buying Bitcoin prior to now few years, whereas MSFT solely carried out 103%.

“Bitcoin is the most effective asset that you may personal. The quantity’s speaks for themselves. It’s make alot extra sense to purchase Bitcoin than purchase your individual inventory again, or to carry Bitcoin moderately than holding bonds. In case you needed to outperform you gotta want Bitcoin,” Saylor point out on his presentation posted on YouTube.

Political and market assist, which is represented by Trump’s administration and Bitcoin ETF’s merchandise within the inventory market, can even make Bitcoin massively adopted within the subsequent few years, so Microsoft has, too.

Michael Saylor offers a selections

Saylor offers the board of Microsoft a selection: cling to the previous with the standard monetary technique, which is gradual to develop and will increase investor threat, or innovate that technique by embracing the way forward for Bitcoin with accelerated development.

Michael Saylor’s presentation to Microsoft boards posted on Dec. 01 | Supply: YouTube

He additionally gives Bitcoin24 to the boards, which customizes Bitcoin merchandise for companies, and forecasts Microsoft shares would rise as much as $584 from the latest share value.

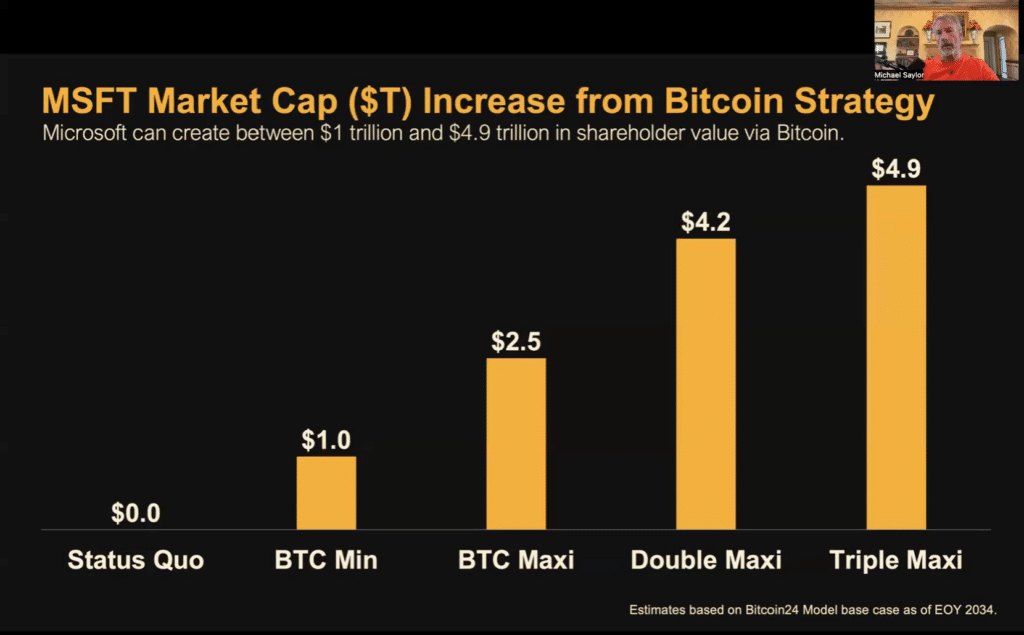

The corporate’s market capitalization can also be going to surge between $1 trillion and $4.9 trillion per share if it implements Bitcoin’s strategic reserve.

Whereas the worth created by the adoption of Bitcoin, Microsoft shares threat is projected to say no from 95% to 59%, and annual recurring income is projected to extend from 10.4% to fifteen.8%.