Bitcoin (BTC) entered a bull run in early November of 2024 — culminating in an all-time excessive (ATH) value of roughly $106,070 on December 17. A correction ensued quickly after — BTC costs receded to $92,630 earlier than briefly breaching the $100,000 mark once more on January 7, 2025 — though the surge didn’t final.

What adopted was one other drop beneath $93,000 — nevertheless, over the past 24 hours, the value of the main cryptocurrency has gone up by 2.74%. At press time, a single Bitcoin was altering palms at $99,450.

The discharge of the U.S. Labor Division’s Shopper Worth Index (CPI) information for December was the first driver behind the surge. Though the CPI’s annual charge got here in on the anticipated 2.9%, core inflation, which got here in at 3.2%, was much less extreme than anticipated.

Whereas nonetheless a methods away from the Federal Reserve’s goal inflation of two%, the better-than-expected outcomes helped assuage traders’ worries relating to a possible charge rise.

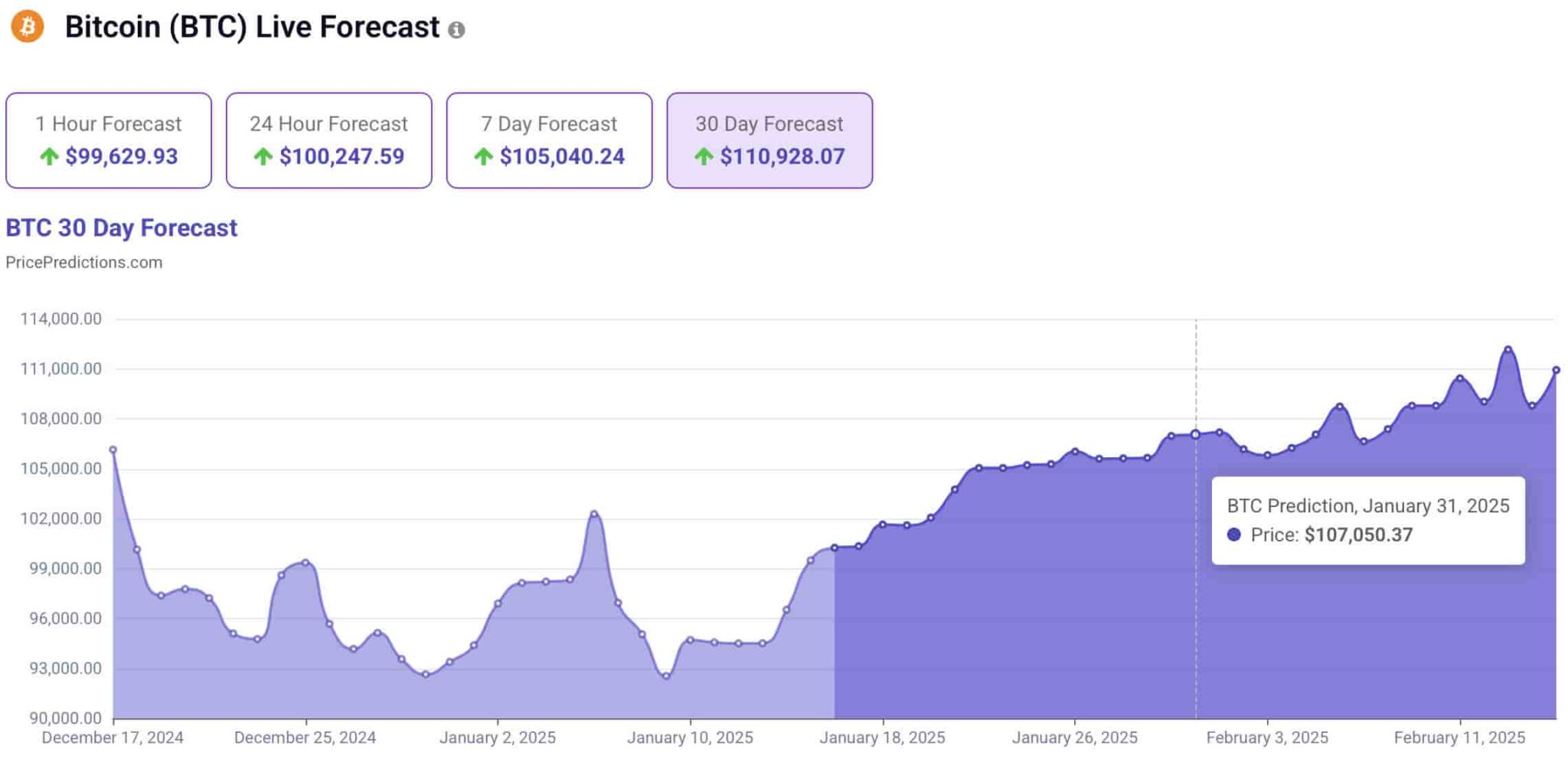

With such sharp and sudden strikes at play, Finbold has determined to seek the advice of the superior AI algorithm utilized by the cryptocurrency analytics and forecasting platform PricePredictions for a greater overview as to which costs BTC may very well be buying and selling by the top of January.

Machine studying algorithm units bullish predictions for Bitcoin costs

Considering the myriad components at play, the algorithm offered an optimistic outlook for Bitcoin’s near-term value motion. In reality, in line with the forecast, BTC may breach the $100,000 mark as soon as extra inside an hour after publication — following which, it may attain costs barely above $105,000 in per week’s time.

Ought to the predictions come true, BTC would finally attain a value of $107,050 by January 31 — nevertheless, additional upward strikes are additionally projected.

Maybe most notably, the PricePredictions algorithm additionally outlines that Bitcoin will attain a brand new all-time excessive of $110,928 by February 15 — a transfer which might little doubt serve to drown out any remaining bearish sentiment and produce about renewed shopping for curiosity.

As formidable as these value predictions would possibly sound, they don’t symbolize fringe opinions — famous cryptocurrency analyst TradingShot just lately outlined how BTC may attain costs as excessive as $200,000 primarily based on earlier market cycles — a sentiment echoed by legendary dealer Peter Brandt, who additionally expects to see a decisive transfer to ranges above $100,000 quickly.

Featured picture through Shutterstock