MicroStrategy shareholders are set to vote on a number of key proposals throughout a particular assembly scheduled for 10 a.m. New York time on Tuesday, in line with a latest report from Bloomberg.

The important thing focus of the vote shall be to approve a rise in approved Class A typical inventory from 330 million shares to 10.3 billion shares. Shareholders can even think about elevating the variety of approved most well-liked shares from 5 million to 1 billion.

Bloomberg reported that MicroStrategy’s upcoming shareholder vote is prone to simply approve the proposed measure, given co-founder and chairman Michael Saylor’s substantial voting energy—roughly 46% via his Class B shares.

The corporate additionally plans to boost as much as $2 billion via most well-liked inventory choices, which might rank senior to Class A shares.

The rise would advance MicroStrategy’s 21/21 plan, which targets elevating $42 billion over three years via share issuances and debt gross sales to assist intensive Bitcoin acquisitions.

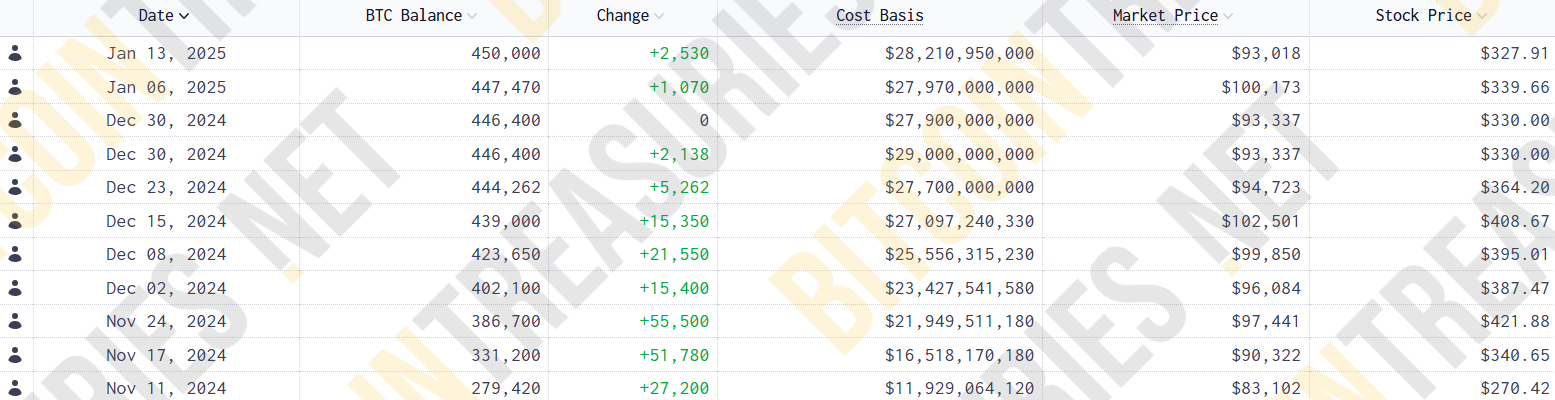

Since revealing the plan, MicroStrategy has accrued 197,780 BTC via 10 consecutive weekly purchases, reaching nearly half of its aim in over two months. Saylor beforehand advised Bloomberg that the corporate would re-evaluate its capital allocation technique after attaining the aim.

The upcoming assembly can even tackle amendments to the corporate’s fairness incentive plan, together with computerized fairness grants for newly appointed board members.

Following its newest Bitcoin buy, MicroStrategy maintains $6.5 billion of fairness choices remaining underneath its $42 billion plan.

The Tysons, Virginia-based agency at the moment holds roughly 450,000 BTC, valued at $48.5 billion at present market costs. It has invested roughly $28 billion in its Bitcoin holdings at a median value of $62,691.