Because the crypto market prepares for turbulence amid the tariff wars, the NFT market appears to be in a worse place.

Buying and selling volumes are declining and marketplaces shutting down.

The once-hyped world of non-fungible tokens, which analysts as soon as boldly projected may balloon to over $264 billion by 2032, now appears to be limping alongside. Weekly buying and selling volumes have been falling like dominoes for weeks, scaring off capital and dragging the market again to ranges not seen since its explosive 2020 debut.

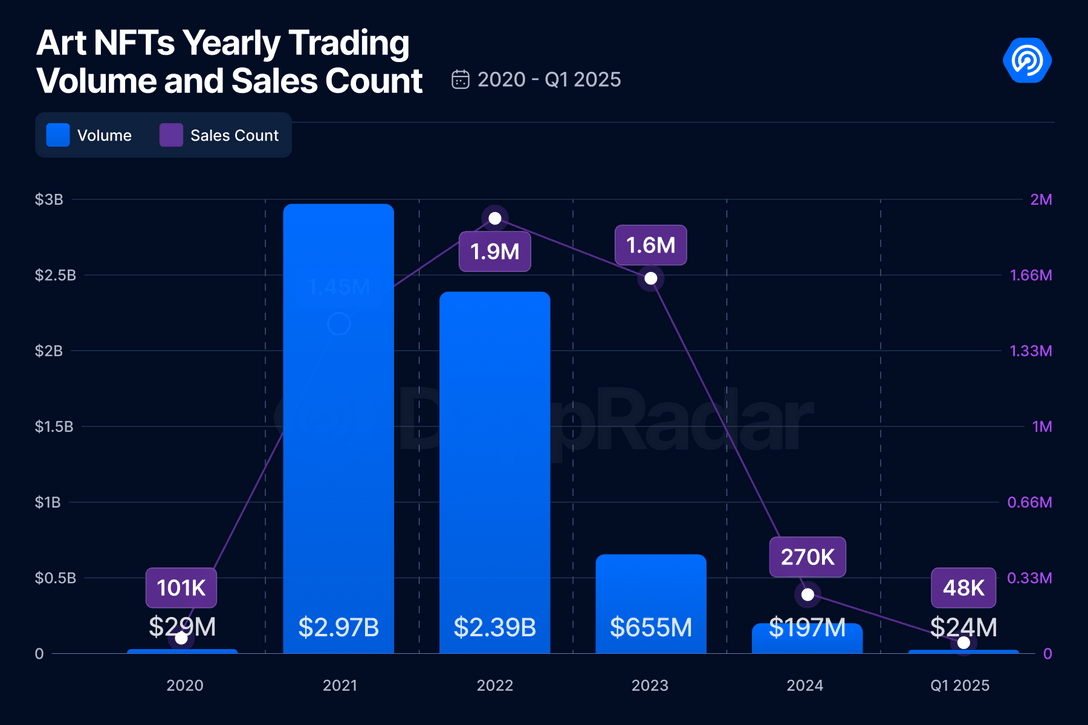

Artwork NFTs yearly buying and selling quantity and gross sales rely | Supply: DappRadar

Blockchain analytics agency DappRadar exhibits that buying and selling volumes in 2021 have been driving excessive, hitting almost $3 billion.

Quick-forward to the primary quarter of 2025. That determine has nosedived 93% to simply $23.8 million as “energetic merchants have vanished,” blockchain analyst Sara Gherghelas famous.

“This speedy development coincided with international shifts pushed by the COVID-19 pandemic, accelerating the adoption of digital platforms and pushing artists to discover progressive strategies of partaking with their audiences. Nevertheless, three years later, the hype round Artwork NFTs has considerably decreased.”

Sara Gherghelas

The info backs her up. In 2024, buying and selling quantity dropped almost 20% from the yr prior, whereas complete gross sales declined 18%. As Gherghelas put it in her 2025 analysis, it was “one of many worst-performing years since 2020.”

Nonetheless speculative belongings

In an interview with crypto.information, OutsetPR’s authorized officer Alice Frei implied that regulation continues to be a multitude as “governments are nonetheless undecided on find out how to classify NFTs.”

Within the U.S., they’re typically handled like securities, that means platforms should stroll a authorized tightrope. Within the U.Ok., they’re seen extra like collectibles underneath mental property legislation.

“These are examples of main international locations with clear cryptocurrency laws; in lots of different international locations, the scenario is much more unsure. This lack of regulatory readability creates an surroundings that’s ripe for fraud and erodes investor confidence. Till there may be extra consistency, NFT adoption will stay stagnant.”

Alice Frei

Frei additionally highlighted a deeper problem: past the worlds of cryptocurrency and gaming, NFTs are nonetheless “attempting to show that they provide actual worth.”

“In concept, they might revolutionize a number of industries — assume live performance tickets that forestall scalping, digital IDs for on-line verification, or property deeds saved on the blockchain. However in observe, most NFTs are nonetheless largely speculative belongings.”

Alice Frei

Talking of gaming, the place NFTs have probably the most potential for mainstream use, their adoption can be struggling, Frei identified, recalling that Ubisoft’s Venture Quartz, an try and combine NFTs into AAA video games, was met with “resistance from gamers, forcing the corporate to close it down.”

Frei notes that avid gamers are “hesitant about digital belongings that really feel extra like forex than a real addition to their expertise.”

You may additionally like: What’s an NFT? A whole information to non-fungible tokens

Revolving door

If the information wasn’t already bleak, March introduced extra dangerous information: a string of market shutdowns added gas to the fireplace. Amongst them, South Korean tech big LG shut down its LG Artwork Lab, which was launched simply three years in the past on the peak of the NFT mania. The corporate didn’t share detailed causes, solely saying that “it’s the proper time to shift our focus and discover new alternatives.”

Only a week later, X2Y2 — a former OpenSea rival that after boasted $5.6 billion in lifetime quantity — additionally ceased its operations, citing a “90% shrinkage of NFT buying and selling quantity from its peak in 2021” and struggles to stay aggressive within the house.

Then got here Bybit. The crypto change, nonetheless reeling from a $1.46 billion theft linked to North Korea-affiliated hackers, quietly closed its platform.

Emily Bao, head of web3 at Bybit, mentioned the choice would enable the corporate to “improve the general person expertise whereas concentrating on the subsequent technology of blockchain-powered options.”

Amid the wave of closures, Frei says the NFT market now “appears like a revolving door.”

“Take Bored Ape Yacht Membership, for instance – as soon as the top of NFT standing, its costs have dramatically dropped. On the peak, a single Bored Ape bought for $400,000, however now some are barely fetching $50,000. The issue lies in the truth that many NFT initiatives depend on hype somewhat than precise utility. If folks can not see long-term worth, they’re unlikely to return.”

Alice Frei

Final hope

Coinbase, too, appears to be pulling again. Whereas it hasn’t formally shut down its NFT platform, all indicators recommend it’s shifting focus. Throughout an earnings name in early 2023, President and COO Emilie Choi indicated that the corporate sees “medium and long-term alternatives” in NFTs. However its actual focus appears to be behind Base, its layer-2 blockchain community.

Coinbase declined to touch upon its place as NFT exercise continues to say no, regardless of a number of requests from crypto.information.

The OutsetPR authorized officer thinks that with the market’s present trajectory, smaller platforms are unlikely to climate the storm. “Smaller platforms will proceed to close down, leaving just a few dominant gamers like OpenSea and Blur,” she mentioned.

She defined that the shift is being pushed by two main forces. First, tighter laws are on the horizon, which can probably carry an finish to the “Wild West days of NFTs.” Second, the gaming sector could supply NFTs a lifeline—nevertheless it’s nonetheless a slim one. As Frei places it, gaming could also be NFTs’ “final hope,” although builders will nonetheless have to keep away from “pay-to-win mechanics that would flip gamers away.”

“The hype is over. If NFTs are to outlive, they might want to show that they provide extra than simply costly photos on the blockchain,” Frei concluded.

Learn extra: NFT gross sales slip 5.3% to $100.9m, Bitcoin NFT gross sales drop 30%