Although Bitcoin’s (BTC) journey between December 4 and December 6 proved one thing of a spherical journey, the momentary surge towards $104,000 seems to have turned traders – and gamblers – decisively bullish.

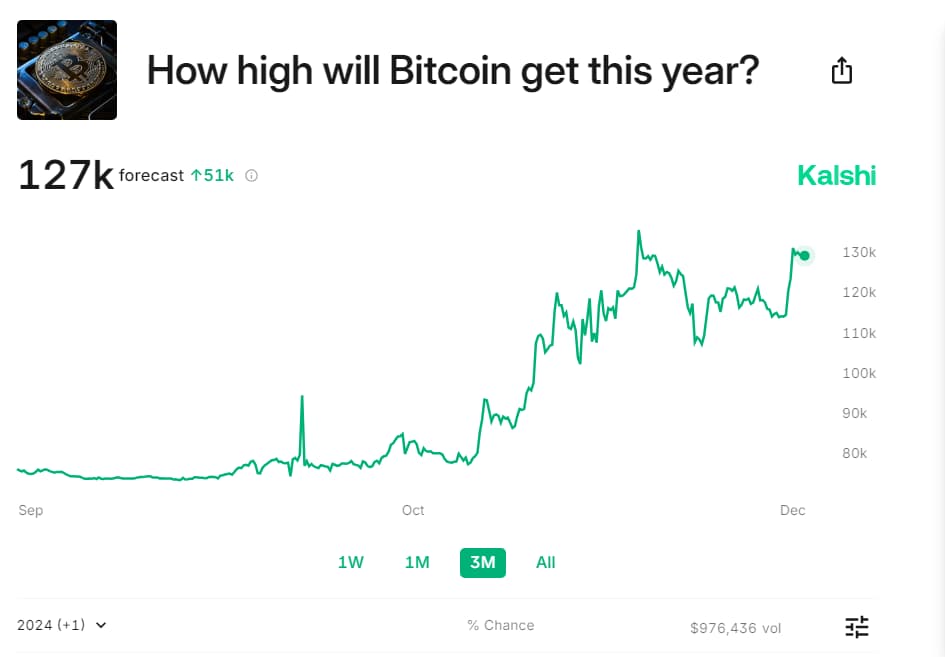

Particularly, the group energetic on the Kalshi prediction market – one of many two that rose to fame forward of the 2024 U.S. presidential election – seems assured that BTC will hit a brand new all-time excessive (ATH) within the remaining weeks of the 12 months.

Particularly, the platform is, at press time on December 6, forecasting Bitcoin will stand at a excessive $127,000 on New 12 months’s Eve.

Can Bitcoin attain $127,000 earlier than the tip of 2024?

Although the goal may seem so lofty that it’s out of attain, it’s price mentioning that it could symbolize a 29.28% rise from the press time value of $98,235 and that the world’s premier cryptocurrency rocketed 31.96% within the final 30 days. If December 5 highs are taken as an endpoint, Bitcoin’s whole 30-day upswing amounted to 48.43%, making 29.28% extra believable.

Whereas the uncooked figures actually paint BTC’s rise to $127,000 as believable, the coin’s historic efficiency demonstrates why the probability of the transfer stays uncertain.

Particularly, the cryptocurrency has been following a sample of rallies adopted by corrections which might be themselves adopted by a sequence of retestings of latest highs. Thus far, this sample has largely led to protracted durations of sideways buying and selling with periodic and momentary downward shocks.

Why Bitcoin may commerce sideways by the beginning of 2025

For instance, after hitting $73,000 in March, Bitcoin shortly corrected towards $60,000 earlier than discovering its footing within the unstable vary between $60,000 and $70,000. Moreover, BTC remained on this vary till November, with probably the most important shifts coming when the secure ranges modified downward from about $67,000 to $63,000.

Whereas more moderen buying and selling has been extra dynamic, this habits may also be seen within the final 30 days. The coin quickly rocketed towards $99,000 after November 6 however sustained a powerful uptrend for about two weeks earlier than discovering a brand new middle of gravity simply above $95,000.

It’s potential however not confirmed at press time that this secure footing shifted upward and nearer to $98,000.

BTC technical evaluation

Technical evaluation (TA) equally demonstrates the prevalent uncertainty. Bitcoin’s relative energy index (RSI) stands simply above 64, that means the cryptocurrency is neither notably ‘overbought’ nor ‘oversold.’ Nonetheless, with the ‘overbought’ zone starting at 70, it’s evident why the transfer above $100,000 proved temporary.

Lastly, the watershed second for Bitcoin in December may come quickly. Ought to BTC break above its nearest resistance ranges simply above $102,000 – and notably ought to it maintain the value – one other robust rally would change into extremely doubtless. Moreover, a breach of the extra distant resistance at $111,000 would considerably bolster the case for an increase to $127,000.

It’s also price mentioning that the bullish case is additional bolstered by the vacations on the finish of the month for the reason that lower in quantity may result in higher value swings.

Concurrently, a big drop is unlikely as Bitcoin has, to this point, efficiently held above the closest help close to $92,000, indicating a correction down towards $86,000 is inconceivable, although not unimaginable, in 2024.

BTC value right now

No matter Bitcoin’s closing 2024 value finally ends up being, the cryptocurrency has achieved remarkably nicely for the reason that 12 months began. For instance, even when the 4.11% 24-hour drop is included, BTC stays 1.46% within the inexperienced within the final 7 days.

Moreover, zooming out to the year-to-date (YTD) chart demonstrates why the memes depicting pleasure over Bitcoin reaching a sure value on in the future after which despair 24 hours later as soon as it falls to the very same worth have change into so standard. Certainly, BTC is 130.02% within the inexperienced in 2024.

Featured picture by way of Shutterstock