Ripple’s native token XRP has gained huge consideration from crypto fans as a consequence of its spectacular upside rally over the previous few days. On November 24, 2024, a whale transaction tracker, Whale Alert, posted on X (previously Twitter), signaling each investor and dealer that this rally may be nearing its finish.

XRP Whale Transfer 20 Million Tokens to Upbit

The put up on X famous that an XRP Whale had dumped 20 million tokens value $27.24 million on Bybit, South Korea’s largest crypto alternate. Nevertheless, this huge dump occurred throughout a interval when the general cryptocurrency market was in a correction section, and XRP itself was struggling.

🚨 🚨 20,000,000 #XRP (27,244,343 USD) transferred from unknown pockets to #Bybithttps://t.co/mb7q3SbRYt

— Whale Alert (@whale_alert) November 24, 2024

Following this dump on the centralized alternate (CEX), XRP’s every day chart seems bearish, suggesting its worth might face a big correction.

XRP Technical Evaluation and Upcoming Stage

In line with skilled technical evaluation, XRP seems to be forming a bearish night star candlestick sample close to the breakout degree of $1.40. Primarily based on latest worth motion, if the altcoin efficiently varieties this candlestick sample and closes the every day candle under the $1.30 degree, it might drop by 20% to achieve $1.05 within the coming days.

Supply: Buying and selling View

Nevertheless, XRP has skilled a parabolic transfer, and to maintain this momentum within the coming days, the asset may have to bear a correction or a interval of worth consolidation.

At present, the altcoin is buying and selling above the 200 Exponential Transferring Common (EMA) on the every day timeframe, indicating an uptrend. Nevertheless, its Relative Power Index (RSI) suggests restricted room for additional rally, as its worth has been above 80 since November 11, 2024, indicating that the asset is in overbought territory.

Merchants Sentiment: Bullish or Bearish

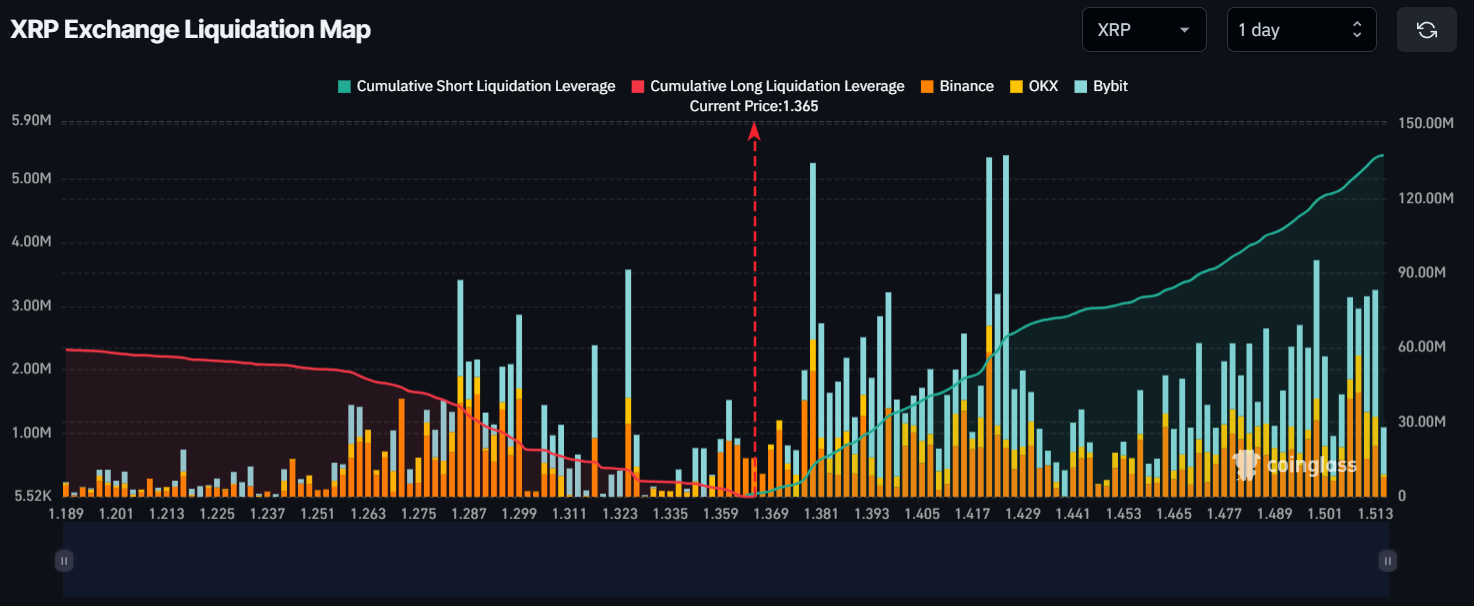

Except for whale exercise, readers could marvel what merchants are presently as much as. Information from the on-chain analytics agency Coinglass means that merchants are over-leveraged, with key ranges at $1.325 on the decrease aspect and $1.379 on the higher aspect.

Coinglass’s alternate liquidation map additional signifies that merchants have held $10.76 million value of lengthy positions on the decrease degree, whereas $12.41 million value of brief positions are concentrated on the higher degree.

Supply: Coinglass

This liquidation knowledge signifies that sell-side merchants are comparatively greater, which might result in a worth decline within the coming days.

Present Value Momentum

At press time, XRP is buying and selling close to $1.38 and has recorded a worth decline of seven.10% previously 24 hours. Throughout the identical interval, its buying and selling quantity dropped by 30%, indicating decrease participation from merchants and buyers in comparison with the day prior to this.