- Tron leads April 2025 blockchain income with $11.2M, pushed by excessive person exercise.

- Ethereum dominates TVL however lags in income as a result of decrease day by day energetic addresses.

- Solana information highest person exercise, whereas Base and Arbitrum present rising income potential.

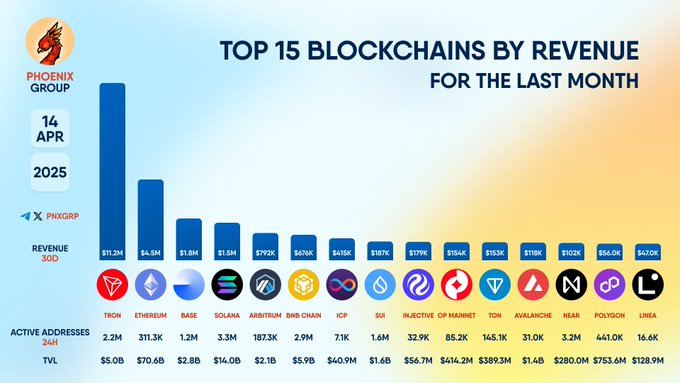

In response to newly launched information from Phoenix Group, Tron posted the best blockchain income in April 2025, pulling in $11.2 million over the month. The earnings positioned Tron on the high of the income chart and highlighted rising disparities between high-activity chains and people with bigger complete worth locked (TVL). Whereas Ethereum continues to dominate TVL, its income efficiency fell wanting matching Tron’s, emphasizing the shifting dynamics in blockchain community economics.

TOP 15 BLOCKCHAINS BY REVENUE FOR THE LAST MONTH#Tron #Ethereum #Base #Solana #Arbitrum #BNBChain #ICP #Sui #Injective #OPMainnet #Ton #Avalanche #Close to #Polygon #Linea pic.twitter.com/bRrDIOcbgW

— PHOENIX – Crypto Information & Analytics (@pnxgrp) April 14, 2025

Ethereum recorded $4.5 million in income in April, lower than half of Tron’s month-to-month earnings. Regardless of its TVL of $70.6 billion, the best amongst all blockchain networks, Ethereum noticed decrease person exercise.

Knowledge from the identical interval confirmed that Ethereum had 311,300 energetic addresses over 24 hours, whereas Tron registered 2.2 million. The broad hole in day by day person participation seems to be a central driver behind Tron’s stronger income output, suggesting that transaction quantity and person exercise could overtake TVL as a key income determinant.

Base, Solana, and Arbitrum Observe Behind in Earnings

Base, Solana, and Arbitrum rounded out the highest 5 revenue-generating blockchains for the month. Base earned $1.8 million, Solana introduced in $1.5 million, and Arbitrum recorded $972,000. Whereas these numbers place them effectively behind Tron and Ethereum, they nonetheless sign a rising share of the general blockchain income panorama.

Supply: X

Among the many three, Solana stood out for its community utilization. It recorded 3.3 million energetic addresses inside 24 hours, the best amongst all chains included within the dataset. Nonetheless, Solana’s TVL stood at $14 billion, which, whereas greater than Base’s $2.8 billion and Arbitrum’s $2.1 billion, nonetheless fell effectively wanting Ethereum’s holdings.

Decrease-Tier Networks Additionally Contribute to Month-to-month Income

Beneath them, a number of different networks recorded barely decrease however equally spectacular revenues. BNB Chain was on the high, by April the undertaking raked $867K, adopted by the Web Pc Protocol with $415k. Sui recorded $197,000 whereas Injective’s OP Mainnet generated $153,000 of revenues. Ton reached $118,000 over the identical interval.

Different chains within the rating embrace Avalanche, Close to, Polygon, and Linea. Every of those chains earned between $56,000 and $118,000 in income, displaying how the Phystec area has differentiated itself and is aggressive each in Layer 1 and Layer 2.

Income Doesn’t At all times Mirror TVL

The report additionally highlighted the disconnect between income technology and complete worth locked. Ethereum, as an illustration, holds the biggest TVL at $70.6 billion, but its income fell effectively behind Tron’s, which maintains simply $5 billion in TVL. Solana’s $14 billion TVL can also be greater than Tron’s, but it recorded much less month-to-month income.

The April 2025 income rankings add to the rising complexity of evaluating blockchains. Whereas Ethereum maintains a robust place as a result of its TVL and established ecosystem, Tron’s lead in income suggests person exercise and community throughput have gotten extra crucial components in assessing blockchain efficiency.

The elevated exercise degree and the excessive income charge trace at the truth that Tron is already on the way in which to change into one of many leaders when it comes to monetization of a blockchain platform. The center and higher tiers additionally present Base, Solana, and Arbitrum networks that indicate that effectivity and adoption are driving forces within the competitors.