Later right now, US President Trump will have a good time what he refers to as Liberation Day by persevering with with a tariff coverage to scale back American reliance on international merchandise. Relying on the severity of the tariffs, the home crypto-mining business will endure appreciable losses.

In an interview with BeInCrypto, Matt Pearl, director of the Strategic Applied sciences Program on the Middle for Strategic and Worldwide Research (CSIS), defined that levies on China will inherently disrupt provide chain dynamics and enhance operational prices for the US mining business.

How Will Liberation Day Tariffs Affect Mining Prices?

Later right now, Trump is predicted to unveil sweeping tariffs on US imports as a part of an financial agenda he denominated as Liberation Day. Nevertheless, particulars on how aggressive they are going to be or which international locations will likely be most focused have been lackluster.

The absence of knowledge surrounding the occasion has left the better public at the hours of darkness, guessing what is going to occur subsequent. Within the case of the US mining business, contributors will watch Trump’s bulletins concerning China.

Slightly over a month in the past, the Trump administration slapped a brand new 10% tariff on items from China on prime of the present 10% tariff it had enacted solely weeks earlier than. Throughout his marketing campaign path, Trump even proposed as much as 60% border taxes on Chinese language items.

If Trump applies additional levies on China in mild of Liberation Day, American Bitcoin miners must make many choices concerning the character and scale of their future operations.

ASIC {Hardware}: The Essential Import

Crypto mining closely depends on Software-Particular Built-in Circuit (ASIC) tools. These laptop chips are constructed to carry out the complicated mathematical calculations required to validate transactions and mine new cash. They’re significantly indispensable in Bitcoin and different proof-of-work cryptocurrencies.

ASICs have change into the dominant {hardware} in Bitcoin mining attributable to their superior efficiency over different forms of {hardware}, reminiscent of CPUs or GPUs. They provide a a lot greater hash charge per unit of power consumed and are designed for particular mining algorithms.

“It’s an extremely R&D-intensive course of to create an ASIC that’s power environment friendly and does all the things you want within the context of Bitcoin mining,” Pearl defined.

America closely depends on imports of ASIC mining {hardware}, with a considerable portion coming from China. China, the US’s longtime commerce rival, has well-established manufacturing capabilities for producing superior semiconductor chips.

American Reliance on Chinese language {Hardware} Gear

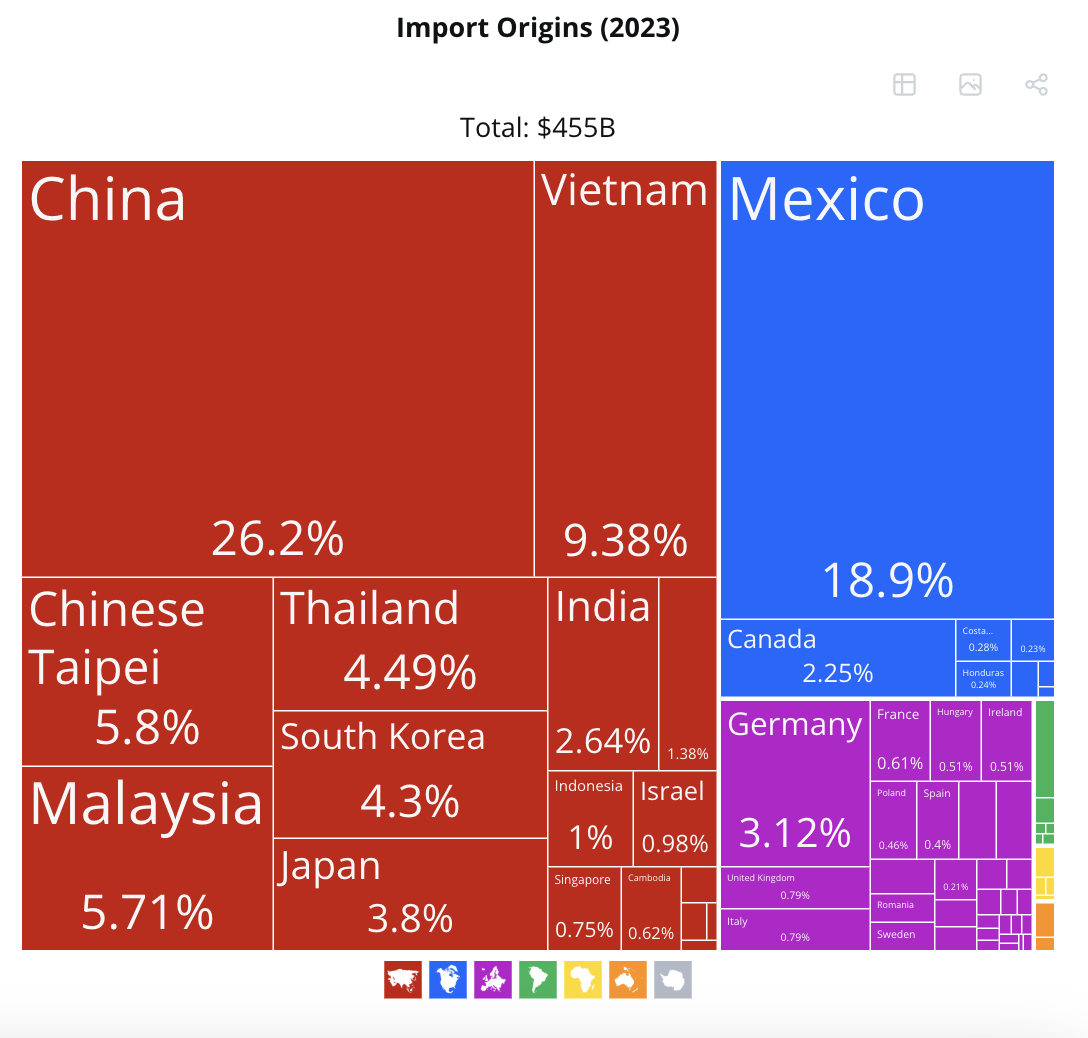

In response to the information from the Observatory of Financial Complexity (OEC), in 2023, america turned the world’s largest importer {of electrical} equipment and electronics. That yr, it imported $455 billion value of {hardware}, reminiscent of built-in circuits (ASICs), semiconductor gadgets, and electrical transformers.

America imports the biggest quantity {of electrical} equipment from China. Supply: OEC.

Electrical equipment and electronics had been recorded because the second-largest import class, with China supplying $119 billion of that complete, comfortably consolidating its place because the US’s prime vendor.

In January 2025 alone, america’ Electrical equipment and electronics exports accounted for as much as $19 billion, and imports amounted to $41.3 billion, with most imports coming from China.

Provided that the US closely will depend on China for this specialised {hardware}, any tariffs imposed on digital imports from China would instantly have an effect on the price of ASIC mining {hardware} within the US.

Although much less extreme, Trump’s tariff insurance policies throughout his first time period in workplace supply a glimpse into their potential influence on cryptocurrency miners.

Classes from Trump’s First Time period

In June 2018, america Commerce Consultant underneath Trump reclassified Bitmain, a Chinese language Bitcoin mining {hardware} maker, from a “knowledge processing machine” to an “electrical equipment equipment.” Bitmain, particularly its “Antminer” sequence, is a number one producer of ASIC mining {hardware}.

By reclassifying the {hardware}, a 2.6% tariff was added to the present 25% tariff on Chinese language items. This successfully raised the entire tariff on US shipments for Chinese language crypto mining tools to 27.6%.

Mining {hardware} prices are one of many largest enter prices operators within the American mining enterprise face. Following the tariff hike, crypto miners inevitably noticed their manufacturing prices enhance considerably.

The present cumulative 20% tariffs on Chinese language items and the potential for additional will increase after Trump’s Liberation Day bulletins counsel an identical or extra extreme influence.

“Within the quick to medium time period, [the US mining industry] is extraordinarily susceptible, significantly as a result of a lot of the Bitcoin mining tools is coming from China. ASICs aren’t straightforward to supply, and so it’s going to boost the worth of Bitcoin mining tools within the US. It did in 2018 when Trump imposed tariffs in his first time period, and it’ll be much more important this time,” Pearl informed BeInCrypto.

Other than elevated prices, tariffs will even trigger a disruption in provide chain dynamics for mining {hardware}.

Provide Chain Disruptions: A Looming Menace

In response to Pearl, US crypto miners can anticipate delays and shortages in mining {hardware} if Trump applies additional tariffs on China. His judgment is principally based mostly on the truth that that is already occurring.

“We’re already seeing delays. We’ve already seen Customs and Border Patrol taking longer to look at the tools and clear it by customs, and you then additionally had the US Postal Service that had very briefly halted bundle shipments from China,” Pearl defined.

Two months in the past, the US Postal Service (USPS) introduced that it had briefly suspended bundle deliveries from China shortly after Trump imposed 10% tariffs on Chinese language imports. USPS clarified that the suspension stemmed from eradicating an exemption permitting duty-free, inspection-free shipments underneath $800.

“The USPS and Customs and Border Safety are working carefully collectively to implement an environment friendly assortment mechanism for the brand new China tariffs to make sure the least disruption to bundle supply,” the Postal Service stated in a press release.

The suspension, nevertheless, was reversed lower than 24 hours later. But, with new tariffs on the horizon, an identical state of affairs can play out, threatening to backlog mining plans for American Bitcoin miners.

“As soon as [Trump] imposes the tariffs it’ll be much more important by way of, it’ll increase prices, it’ll depress the quantity that’s despatched, after which it’ll increase uncertainty about whether or not the Customs and Border Patrol or others will sluggish issues down once they do get to the US. It’s tougher for firms to have assurance about once they’ll have the ability to truly start mining,” Pearl added.

If tariffs persist, US crypto mining firms would require appreciable long-term restructuring.

Will US Miners Relocate Attributable to Tariffs?

Although there’s no proof that American crypto mining firms relocated attributable to Trump’s tariff coverage throughout his first presidency, this selection is a believable consequence this second time round.

“I believe the distinction this time is that there’s much more uncertainty. The President appears to be rather more targeted on tariffs and up to now, plainly there’s a scarcity of permanence to the administration’s selections. There’s an imposition of tariffs, however then they’ll alter them or enhance them, so I believe that there’s simply much more uncertainty than there was within the first administration. That’s what would make it completely different, by way of seeing extra relocation of the mining business elsewhere, outdoors of the US,” Pearl informed BeInCrypto.

Clara Chappaz, France’s Digital Minister, instructed monetizing EDF’s surplus power by Bitcoin mining this week. EDF is the nation’s largest state-owned power firm. In response to Chappaz, this method might assist cut back the corporate’s debt. Many within the broader crypto group celebrated the concept.

If Europe surrenders itself to those methods, would possibly American firms really feel extra inclined to maneuver their operations overseas? Pearl says sure, however Europe shouldn’t be the area of choice.

“I believe the countervailing factor is that labor prices are costlier in Europe. There could be a lot extra pink tape in allowing and really constructing the infrastructure. I ponder if there are different regulatory and labor boundaries that can make a shift to Europe much less possible than a shift to different components of Asia,” he stated.

Nevertheless, easy relocation received’t eradicate the necessity for entry to a constant ASIC provide.

An Unlikely End result

To date, no nation has been capable of produce ASICs to the dimensions and pace that China has. It may additionally be in China’s greatest curiosity to relocate its operations to america.

“It’s doable that among the Chinese language firms that produce this tools will truly find manufacturing capability within the US in order that they aren’t topic to the tariffs. However that entails relocating amenities and getting permits. It’s one thing that takes time, and it’s not going to occur tomorrow,” Pearl stated.

Nevertheless, given the hostility between the 2 international locations, this appears unlikely.

In the end, home manufacturing provides the perfect path to US self-sufficiency. Nevertheless, it is going to be a posh –and prolonged– course of.

Bringing Operations Onshore

Underneath Biden, Congress permitted the CHIPS and Science Act in July 2022. This laws was designed to spice up home semiconductor manufacturing in america.

Although it doesn’t explicitly single out ASIC tools, its provisions strongly encourage and incentivize the relocation and institution of all forms of semiconductor manufacturing inside US borders, together with these associated to ASICs.

“If the [Trump] administration doesn’t attempt to undo a few of what was completed underneath the CHIPS Act by way of transferring manufacturing capability to the US, it’s doable that over the course of the subsequent a number of years, US firms will develop ASICs which are aggressive. However that’s a long-term challenge– it’s not a simple factor to develop these chips,” Pearl informed BeInCrypto.

Two days in the past, Hut 8, a serious North American Bitcoin mining firm, partnered with Eric Trump to launch American Bitcoin, aiming to show it into the world’s largest pure-play miner.

Whereas this initiative aligns with President Trump’s aim of bringing manufacturing again to the US, Hut 8, like different American miners, depends on ASIC {hardware}. This creates a possible battle together with his tariff insurance policies.

Within the interim, US miners must grapple with the present reliance on Chinese language ASICs.

American firms will proceed to bear the influence of Trump’s tariffs on essential Chinese language crypto mining {hardware}. This may final till the US can effectively onshore broader manufacturing and manufacturing.

If Trump’s Liberation Day bulletins contain additional tariffs on China, home mining firms, massive or small, will see manufacturing prices rise considerably. Disturbances in tightly interrelated provide chain dynamics will even disrupt their operations. How they reply has but to be decided.