U.S. liquidity could also be bottoming out, in keeping with Capriole Investments founder Charles Edwards.

The vibes within the Bitcoin and crypto neighborhood have been something however immaculate up to now two months. After blistering value rallies in This autumn 2024, many had anticipated extra of the identical in Q1 2025, particularly in mild of President Donald Trump’s crypto-friendly stance. However actuality has been fairly the alternative.

Bitcoin has tanked virtually 25% from its highs, and a number of other altcoins have misplaced double that. Amidst this rout, one analyst has highlighted a possible lifeline whilst others assert that we at the moment are in a bear market.

U.S. Liquidity Finds Backside?

Based on Capriole Investments founder Charles Edwards, U.S. liquidity could also be bottoming out.

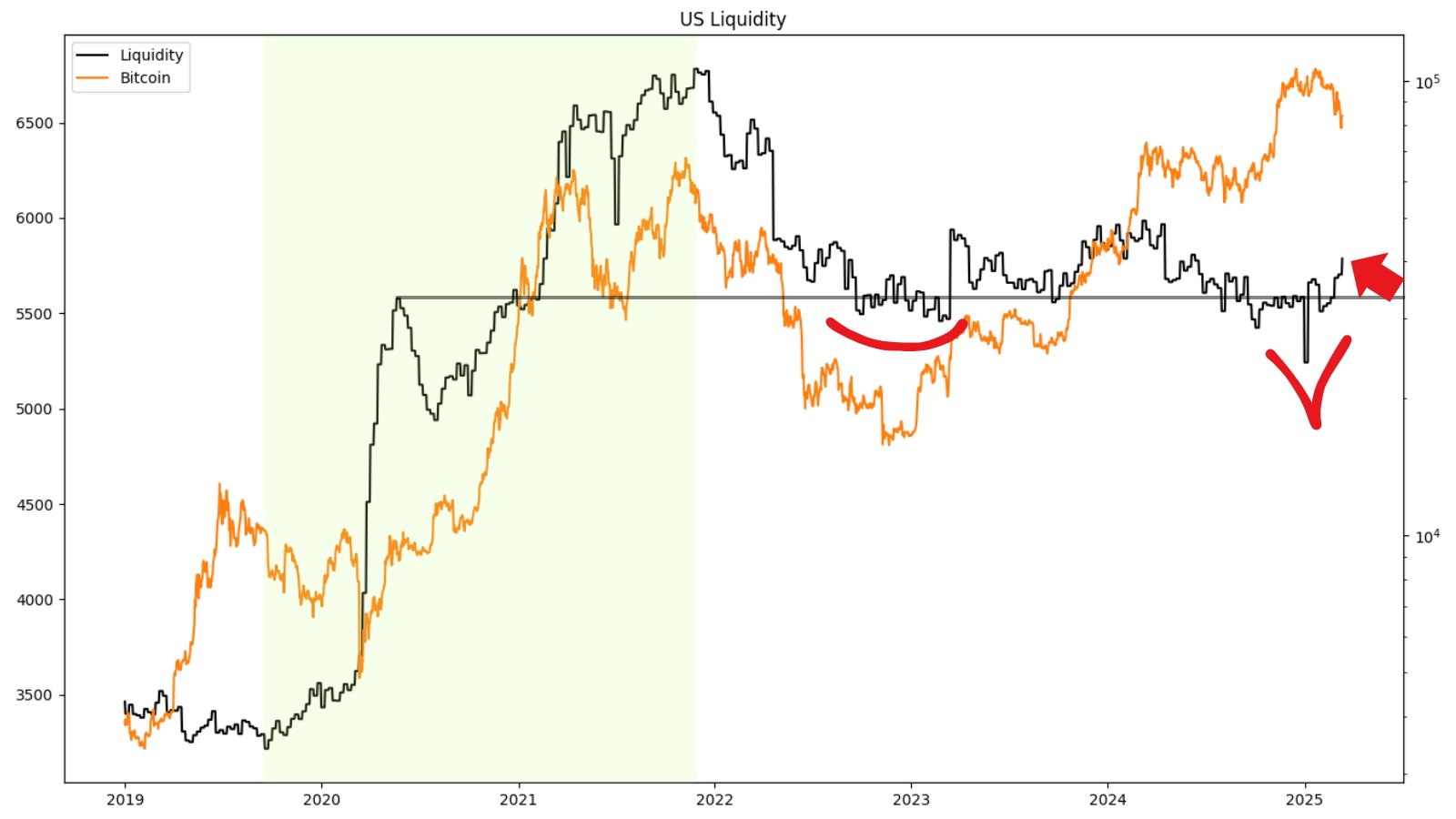

In an X submit on Tuesday, March 18, Edwards asserted that the metric was flashing “the primary indicators” of what may very well be a significant multi-year backside.

Particularly, he famous that the metric seemed to be forming “an Eve/Adam backside,” which refers to a sometimes highly effective reversal sample combining a V (Adam) and U (Eve) formed candlestick formation. It acts just like a double backside.

US liquidity imposed on Bitcoin value chart Supply Charles Edwards

Why It Issues for Bitcoin

U.S. liquidity discovering a backside and rising is essential for Bitcoin as extra liquidity typically finds its approach to threat markets like crypto. As highlighted by Capriole, crypto’s 2021 bull cycle was largely attributed to an increase on this liquidity. Nonetheless, it has remained largely flat within the current cycle, explaining a number of the market’s struggles.

The hedge fund founder famous that 2025 may very well be the precise time for the Federal Reserve to maneuver away from financial tightening as Trump’s tariff insurance policies spark recession considerations.

The potential U.S. liquidity backside formation comes as analysts like CryptoQuant CEO Ki Younger Ju have asserted that we’re in a bear market, warning of continued sideways and even bearish value motion within the coming months. Younger Ju particularly pointed to an absence of recent liquidity in his outlook.

Whereas a possible enhance in U.S. liquidity may theoretically invalidate Younger Ju’s thesis, it does take some time for the liquidity to move into crypto markets.