Bitcoin trades above $96,000 on Tuesday, January 14. The biggest cryptocurrency has recovered from a flash crash underneath $90,000 and macroeconomic headwinds final week. Giant scale profit-taking may push BTC to the help zones on the weekly chart, near the $70,000 stage.

Desk of Contents

Bitcoin market movers and the Trump impact

President elect-Donald Trump’s inauguration on January 20 is a key occasion that merchants hold their eyes peeled. Trump looms giant over cryptocurrencies, together with his pro-crypto picks for Securities and Change Fee Chair, AI & Crypto Czar, and an expectation of pro-crypto regulation.

Bitcoin worth pattern has grown more and more intertwined with U.S. macro strikes previously few weeks. BTC and crypto characterize one of the vital simply liquidable threat belongings, influencing their worth with macroeconomic updates.

Bitcoin began the day decrease, opening above $94,000, and coated misplaced floor, reaching a excessive of $97,371 in immediately’s buying and selling session.

BTC/USDT day by day worth chart | Supply: Crypto.information

The President-elect has been clear on his expectations from the Federal Reserve and promised a strategic Bitcoin reserve for the U.S. Crypto merchants are involved for the reason that central financial institution is impartial and the incoming President is not going to play a task in its decision-making.

The Bitcoin Act proposed by Senator Cynthia Lummis would set up a Strategic Bitcoin Reserve within the U.S., and dollar-denominated debt can be used to purchase 1,000,000 BTC, or simply underneath 5% of the entire absolutely diluted provide of Bitcoin within the subsequent 5 years.

Merchants are awaiting the “Trump impact” on Bitcoin’s worth pattern nearer to the inauguration subsequent week.

Bitcoin analysts at 10X Analysis stay cautious forward of Trump’s time period. Analysts observe that market drivers are weak, and Bitcoin is prone to stay range-bound till mid-March.

At the same time as crypto’s post-election honeymoon part ends, the crypto trade that donated $238 million within the earlier election cycle helped safe 298 pro-crypto lawmakers in Congress. It stays to be seen whether or not the connection is reciprocal and will affect Bitcoin worth in the long run.

Institutional urge for food for Bitcoin cools down, sentiment deteriorates

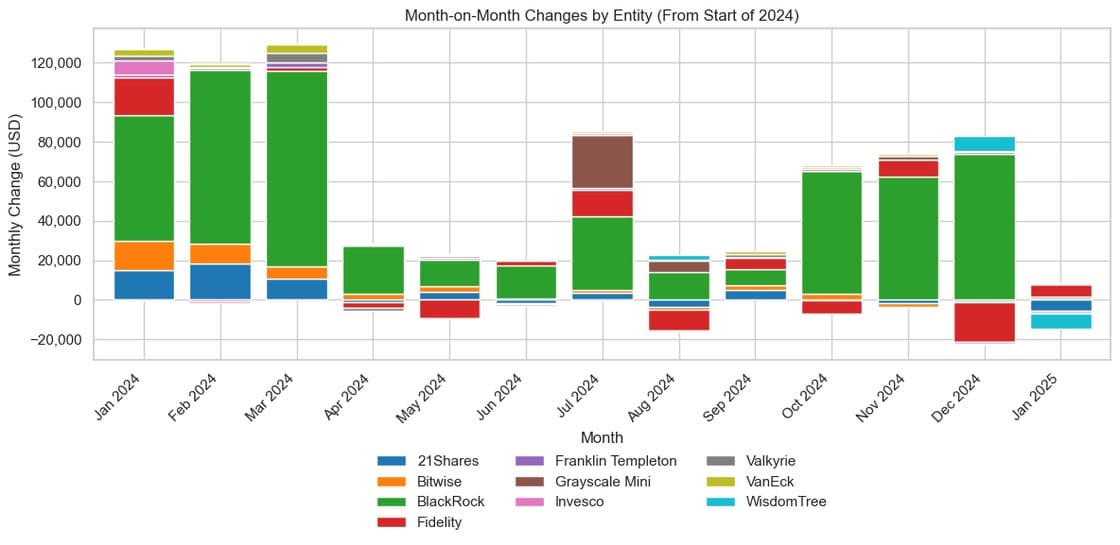

AmberData analysis on Bitcoin ETF dynamics exhibits that establishments have drastically scaled again their inflows to U.S.-based Spot Bitcoin ETFs and sure paused new allocations amidst the current worth retreat. The transfer indicators a risk-off habits by institutional buyers.

Bitcoin merchants’ short-term warning is prone to be adopted by renewed conviction as BTC rallies in the direction of its milestone of $100,000. As Bitcoin worth stabilizes above $95,000, it may make or break the subsequent leg of inflows to Spot Bitcoin ETFs.

Analysis means that sustained inflows from main gamers like BlackRock would sign restored confidence, whereas continued outflows by 21Shares or Franklin Templeton would possibly reinforce a risk-off narrative. Merchants ought to monitor ETF allocations carefully to foretell Bitcoin worth traits, to find out whether or not the asset consolidates or checks new ranges within the coming weeks.

Bitcoin ETF circulation dynamics | Supply: AmberData Analysis

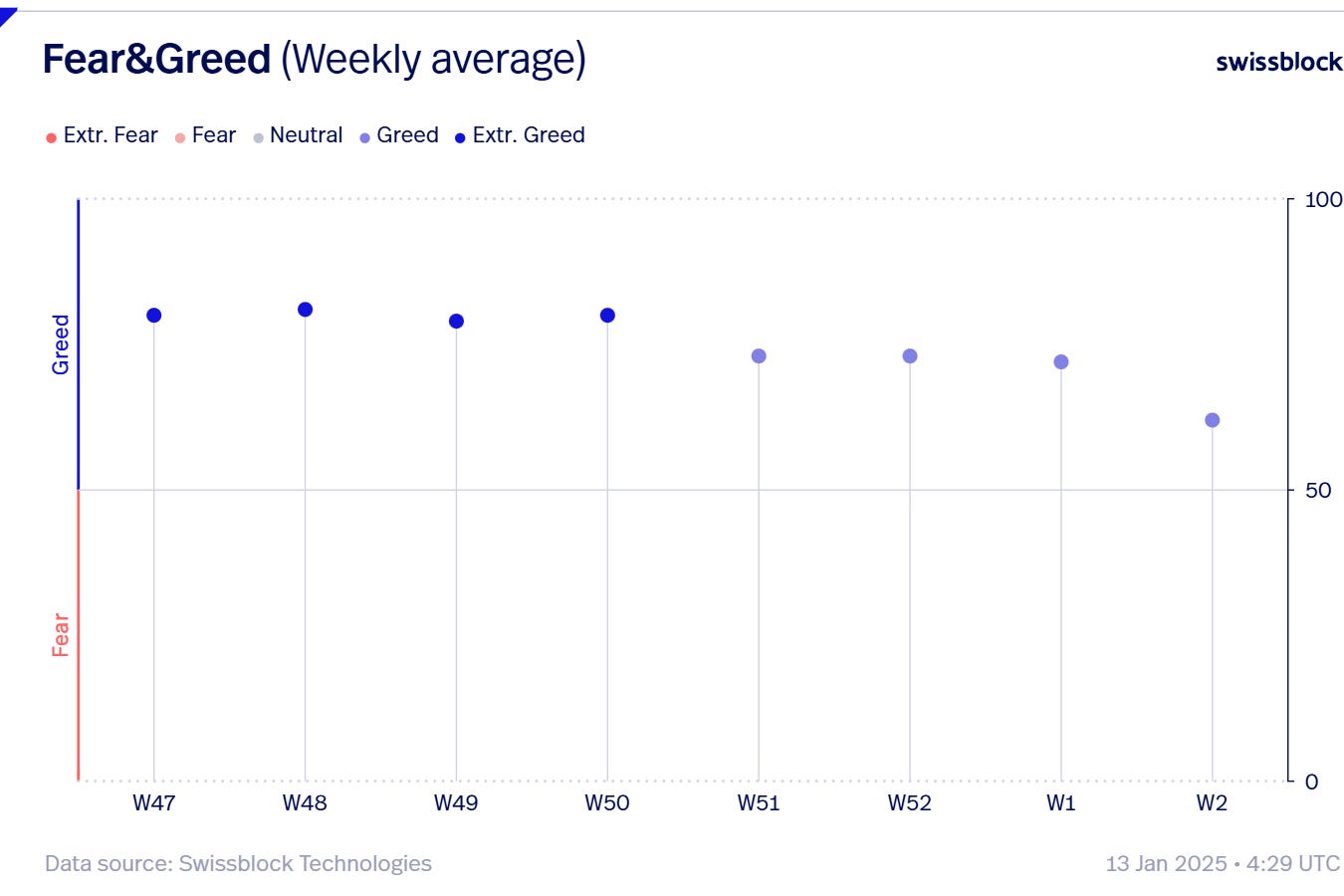

Knowledge from Swissblock insights maps the deterioration of BTC sentiment within the first two weeks of January. As Bitcoin slipped to its $90,000 low, it raised warning amongst merchants and despatched the worry and greed index decrease.

Worry & Greed Index (Weekly common) | Supply: Swissblock

You may additionally like: BlackRock publishes 3 key takeaways to spice up Bitcoin ETF adoption in 2025

Bitcoin on-chain and derivatives knowledge evaluation

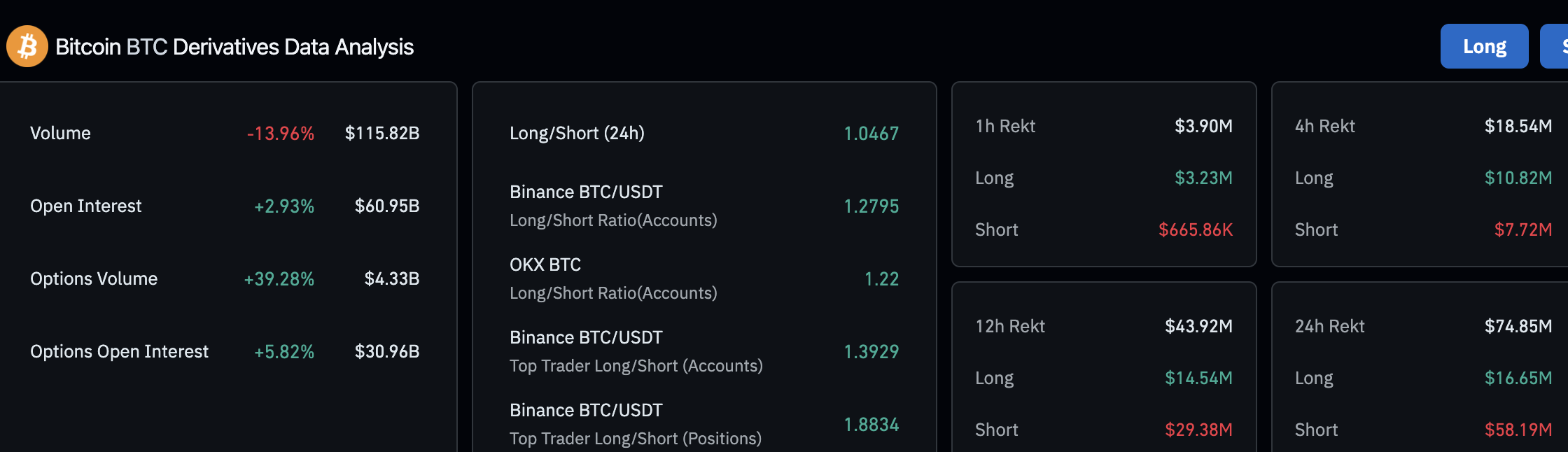

Coinglass knowledge exhibits that Open curiosity and choices commerce quantity has climbed previously 24 hours. As derivatives merchants place themselves for a continued upside forward of Trump’s inauguration, sudden BTC worth strikes may set off a slew of lengthy liquidations and go away the merchants uncovered to the damaging impression on their portfolio.

Bitcoin derivatives knowledge evaluation | Supply: Coinglass

The present optimism amongst derivatives merchants, evident from the lengthy/brief ratio (better than 1) on exchanges like Binance and OKX, may be attributed to an expectation of a crypto-friendly Trump regime.

The Bitcoin log chart and Market worth to realized worth ratio on 10X Analysis exhibits that the token is reaching ranges which are traditionally related to profit-taking by “good cash,” which means giant pockets buyers and establishments. The MVRV ratio has reached 2.7x, this sometimes triggers profit-taking by BTC holders, as noticed in earlier cases.

Traditionally, when the MVRV ratio rises to 4x or 6x it marks the onset of a serious correction in Bitcoin worth.

Bitcoin log chart vs. MVRV ratio | Supply: 10Xresearch

When on-chain evaluation is mixed with an anticipated hawkish stance by the U.S. central financial institution for a number of months, there’s a sturdy likelihood of Bitcoin worth testing help at $76,000 and probably $69,000, a dip underneath the $70,000 mark.

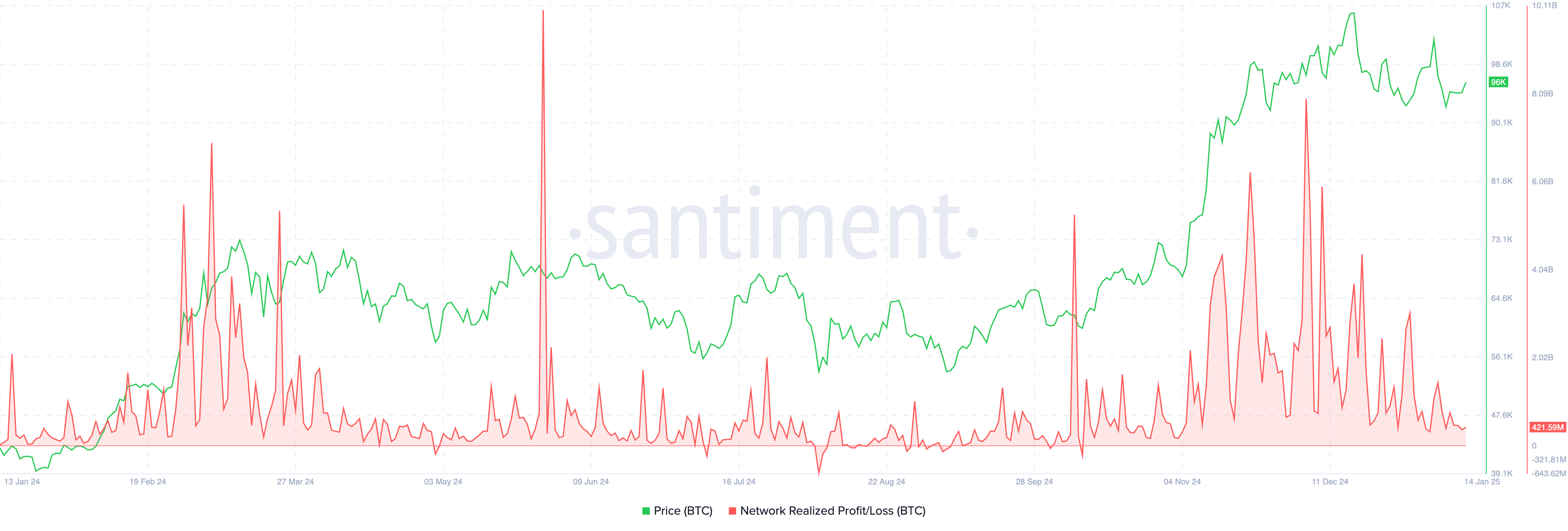

The Community realized revenue/loss metric on Santiment nods in settlement with the MVRV ratio and deteriorating sentiment amongst merchants. Constant profit-taking spikes over prolonged time intervals are related to a correction in Bitcoin worth.

Bitcoin worth vs. Community realized revenue/loss | Supply: Santiment

You may additionally like: Bitcoin to stay in consolidation as fiat-to-stablecoin conversions keep muted, analysts warn

Knowledgeable commentary on the place Bitcoin is headed

In a tweet on X, Keith Alan, co-founder of Materials Indicators, warned crypto merchants of a possible decline to Bitcoin’s 2021 all-time excessive of $69,000. Alan considers $86,000 as a key help stage and the $76,000 stage because the secondary help.

If Bitcoin suffers a steep correction and fails to bounce off the 2 help ranges, it may dip underneath the $70,000 stage.

Been ready for a deeper correction, and it could be creating now, nevertheless I do anticipate one other Trump Pump sooner or later relative to Inauguration Day. After all, should watch to see if it turns into rocket gasoline for a rally or a promote the information occasion.

No matter when or whether or not or… pic.twitter.com/AIQA6uOMPG

— Keith Alan (@KAProductions) January 13, 2025

Sergei Gorev, head of threat, YouHodler, instructed Crypto.information in an unique interview:

“Cryptocurrency quotes additionally present damaging dynamics towards the actively lowering volumes of cryptocurrency buying and selling, because the medium-term vector of motion remains to be unclear to merchants. Every little thing is altering quick sufficient.

BTC quotes have damaged via the resistance stage of $92,000, which can additional result in a decline to $73,000, the place sturdy help within the type of 200 SMA is at present going down.”

Matteo Bottacini and the Crypto Finance staff observe Bitcoin’s fast restoration from its dip underneath $90,000. The primary key inflection level for the next vary is $96,800 and BTC is holding regular above help at $92,000.

Technical evaluation and Bitcoin worth forecast

Bitcoin is at present consolidating across the $96,600 stage. The BTC/USDT day by day worth chart exhibits the formation of two imbalance zones, or help ranges for Bitcoin. The primary one is between $81,500 and $85,072, and the second lies between $76,900 and $80,216.

The $70,000 stage is a key help for Bitcoin and comes into play as soon as BTC fails to bounce from the 2 help zones and continues its decline.

A 27% drop from the present worth may push Bitcoin to check the $70,000 stage as help. This might erase all positive factors in Bitcoin since November 5, 2024, which means post-election BTC rally can be worn out.

The Transferring common convergence divergence indicator exhibits crimson histogram bars underneath the impartial line, which means there’s damaging momentum underlying Bitcoin worth pattern. Relative power index reads 51, near the impartial stage at 50.

BTC/USDT day by day worth chart | Supply: Crypto.information

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.