GameStop’s announcement that it might spend money on Bitcoin drove pleasure throughout the crypto neighborhood. Inside hours, the online game and electronics retailer skilled a major hike in inventory costs. Nonetheless, Bitcoin’s value remained the identical.

In a dialog with BeInCrypto, representatives from Quantum Economics and CryptoQuant defined that Bitcoin’s value was sure to be detached to such a announcement. GameStop lacks the dimensions and scale to meaningfully influence the asset’s buying and selling worth, whereas general hawkish market sentiment restricted important value actions.

Understanding GameStop’s Bitcoin Transfer

On March 26, GameStop introduced an replace to its funding coverage, revealing that it had added Bitcoin as a Treasury Reserve Asset. Mirroring MicroStrategy’s Bitcoin plan, GameStop gambled on crypto publicity to strengthen its monetary place in 2025.

“GameStop including Bitcoin to their stability sheet is a big win for company adoption of the world’s main cryptocurrency,” Mati Greenspan, Founder and CEO of Quantum Economics, advised BeInCrypto in response.

The corporate’s inventory costs jumped as excessive as 12% in a matter of hours earlier than seeing corrections. Group members reacted favorably, together with high-profile figures like Scottie Pippen, six-time NBA champion.

As Pippen’s tweet suggests, GameStop’s announcement parallels latest efforts by totally different institutional gamers to amass Bitcoin holdings. Nonetheless, in contrast to earlier circumstances, the corporate’s initiative didn’t influence Bitcoin’s value efficiency.

Market Indifference Defined

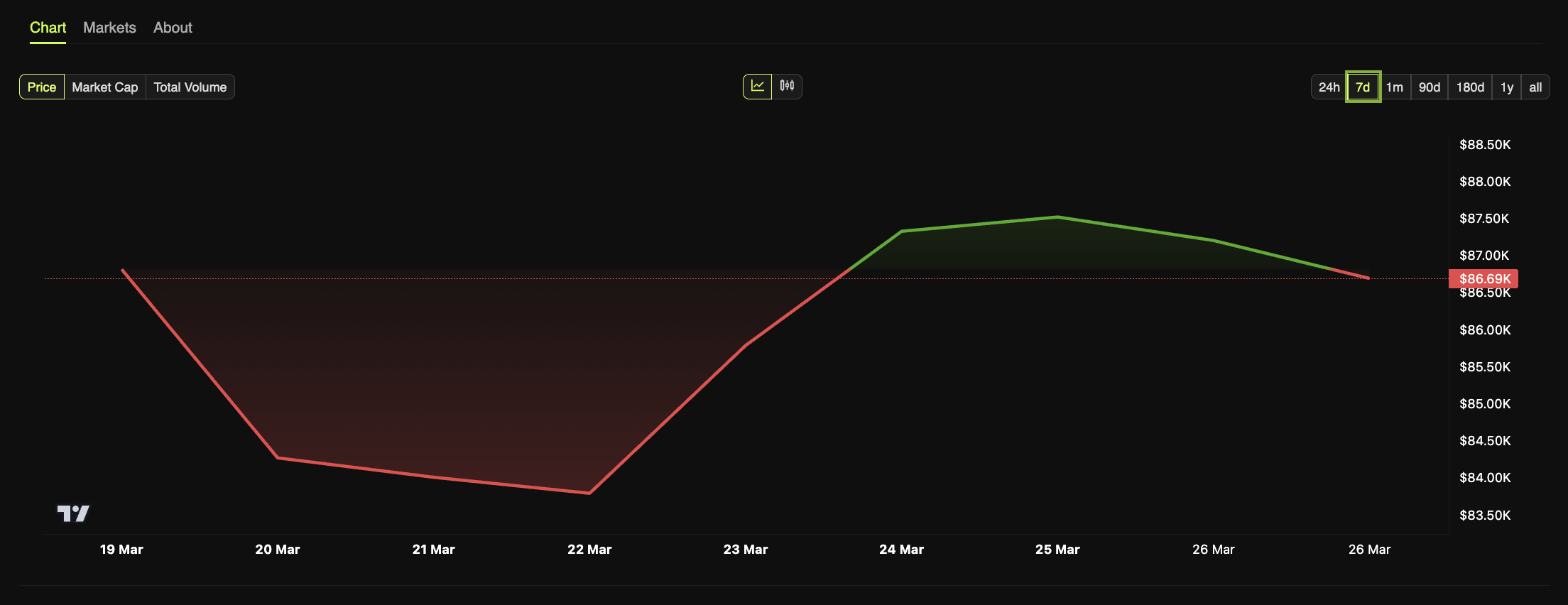

A day earlier than GameStop’s announcement, the value of Bitcoin peaked at $88,474. Yesterday, it fell to a excessive of $88,199. On the time of press, Bitcoin’s value rests at $86,691. In different phrases, Bitcoin’s buying and selling worth has remained unphased by GameStop’s acquisition.

Bitcoin’s value efficiency over the previous week. Supply: BeInCrypto.

On earlier events, these bulletins have pushed BTC’s value by important proportion factors, unleashing a wave of bullish sentiment in buying and selling exercise.

When Tesla, for instance, introduced in February 2021 that it had purchased $1.5 billion price of Bitcoin, the transfer briefly pushed up the cryptocurrency’s value by as a lot as 20%.

Different main gamers like Technique (previously MicroStrategy) and BlackRock and nation-states like El Salvador and Bhutan have additionally acquired large quantities of Bitcoin. However in yesterday’s announcement, GameStop failed to say how a lot BTC it was eyeing.

The agency did point out that it might be issuing $1.3 billion in 0% convertible senior notes to finance this acquisition. But, in comparison with the broader development of publicly listed companies shopping for Bitcoin, this determine is fairly underwhelming.

“The announcement lacked key particulars —most significantly, how a lot Bitcoin they’re truly shopping for. Whereas they’re sitting on about $4.8 billion in money, we’ve seen no indication of what portion, if any, might be allotted to BTC,” Greenspan advised BeInCrypto.

Because of this, the market was left guessing. And not using a clear determine, traders had no cause to react strongly. As an alternative, the assertion served as a message of intent fairly than a concrete market-moving occasion.

However even when GameStop had clarified simply how a lot Bitcoin it was keen to purchase, it nonetheless wouldn’t have made a lot of a distinction in Bitcoin’s value. That is due to the underlying macroeconomic elements which have stored BTC under $90,000 for almost a month now.

Why Didn’t GameStop’s Announcement Transfer Bitcoin’s Value?

Based on its most up-to-date quarterly report, GameStop has a virtually $4.8 billion money stability. Per yesterday’s announcement, the corporate plans to lift $1.3 billion by a non-public providing of convertible senior notes.

It clarified, nonetheless, that the web proceeds from this providing might be used for “common company functions,” which can embrace the acquisition of Bitcoin.

Nonetheless, this stays to be seen. This vagueness creates a scenario with a lot hypothesis however no concrete info.

For Greenspan, even when GameStop used its complete money stability to buy Bitcoin, BTC’s general value would stay unchanged.

“To place issues in perspective, Bitcoin’s on-chain quantity alone averages round $14 billion per day — and that’s not even counting exchanges or ETFs. So even when GameStop went all-in, it nonetheless wouldn’t make a dent,” he stated.

In the meantime, the announcement should even be thought of in mild of the bigger sentiment surrounding the crypto market for the time being.

A Bearish Second for Bitcoin

Market sentiment has been significantly cautious these days. Between Trump’s tariff bulletins and rumors a couple of attainable recession, Bitcoin’s value has remained stagnant.

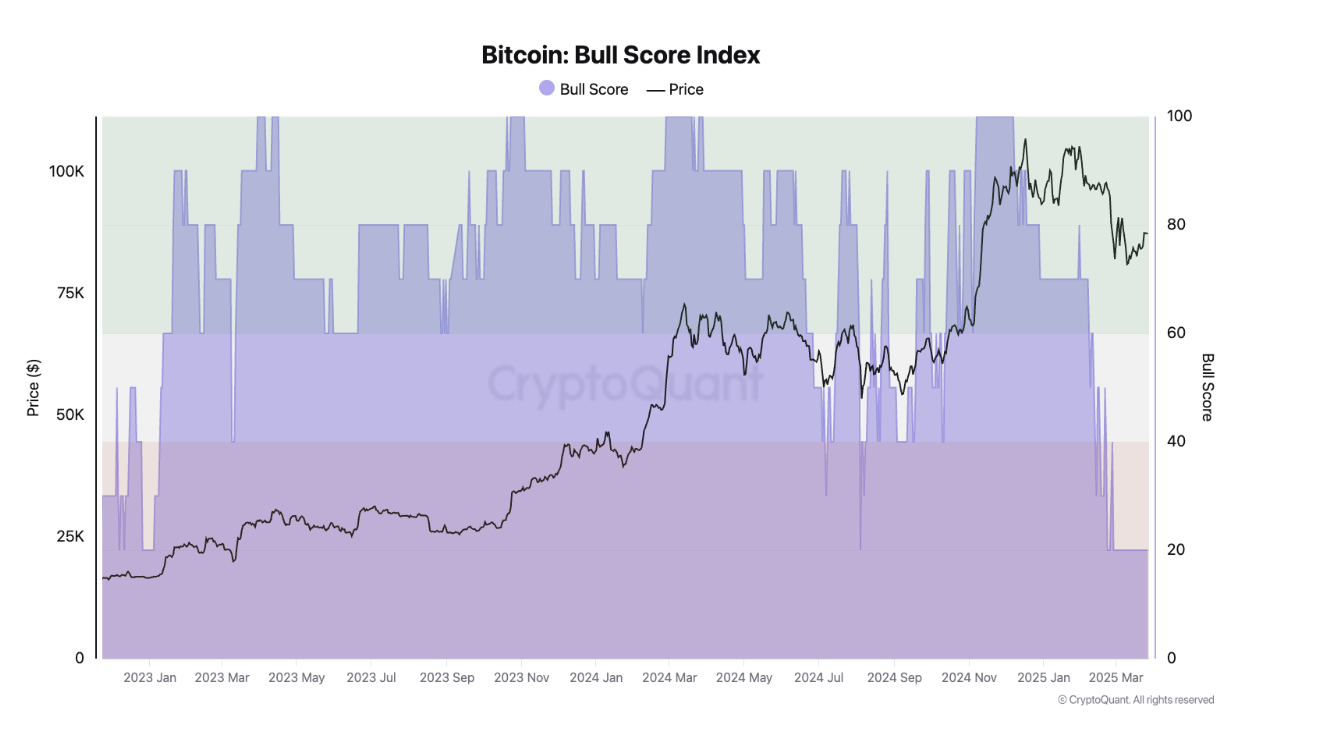

“Total market sentiment stays the least bullish since January 2023 as measured by CryptoQuant’s Bitcoin Bull Rating Index. The index goes from 0 (least bullish) to 100 (most bullish), and it has been at 20 since late February,” Julio Moreno, Head of Analysis at CryptoQuant, advised BeInCrypto.

Bitcoin Bull Rating Index: Supply: CryptoQuant.

Whereas main occasion bulletins have pushed Bitcoin costs up previously, the broader market has been targeted on different elements affecting buying and selling behaviors.

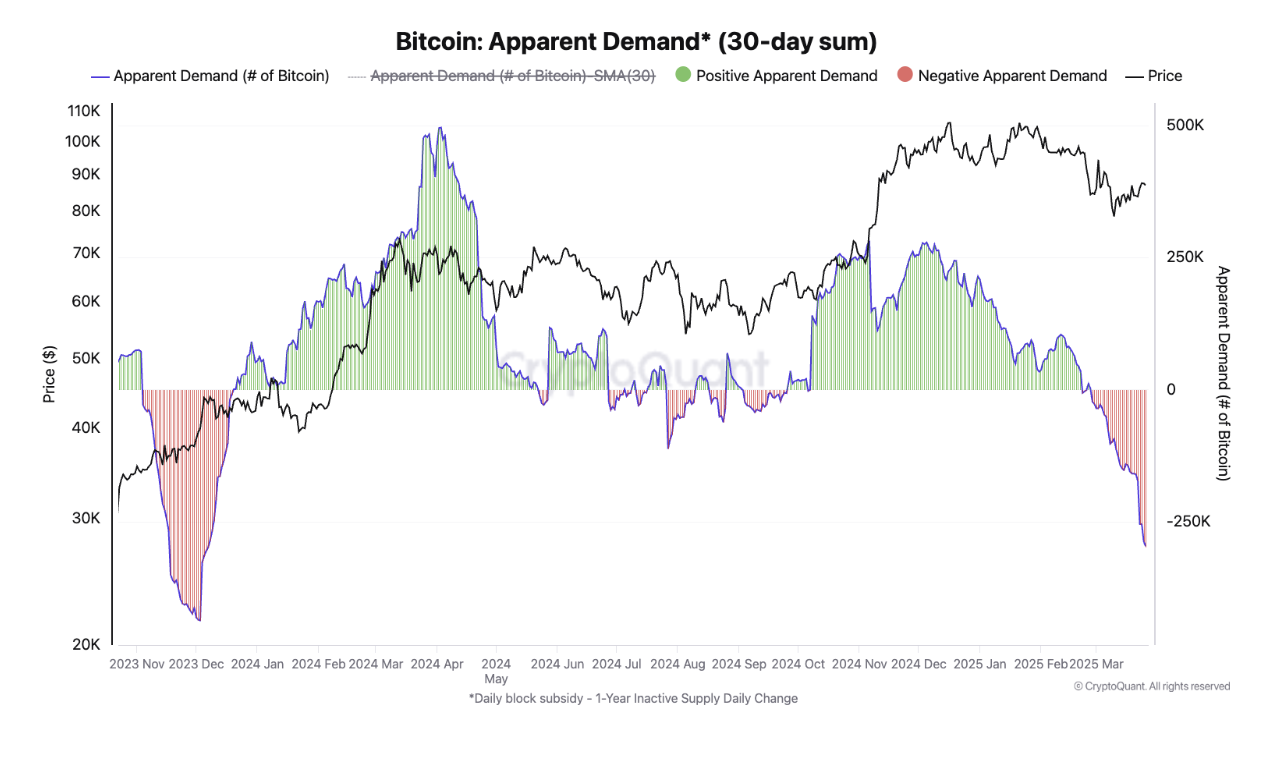

“Bitcoin spot demand development stays in contraction territory, declining by 297K Bitcoin within the final 30 days, the most important contraction for such a interval since December 2023. The market is extra targeted on the macro developments, given expectations of a slowing down financial system and the uncertainty relating to Trump’s Administration tariffs and commerce coverage,” Moreno added.

Bitcoin spot demand development. Supply: CryptoQuant.

Given the better pessimism dampening general market sentiment, bulletins of company purchases are unable to garner sufficient power to influence Bitcoin costs positively.

In the meantime, given how far institutional adoption of crypto has come, company bulletins don’t have the identical influence as they used to.

Has Company Adoption Grow to be Outdated Information?

There’s a case to be made that most people has turn into desensitized to company Bitcoin treasury bulletins. Based on knowledge from Bitcoin Treasuries, non-public corporations worldwide maintain 381,560 BTC price over $33.2 billion, twice as massive as public corporations.

“Extra pertinently, institutional adoption is so final cycle,” Greenspan stated.

Many more moderen bulletins that reach past the scope of BTC holdings in non-public corporations have rocked the market, inflicting costs to surge.

The market went berserk when spot Bitcoin ETFs started buying and selling in January final 12 months. For the primary time, Bitcoin turned obtainable to a a lot wider pool of institutional traders who have been beforehand hesitant to speculate straight within the cryptocurrency.

This occasion led to a major inflow of capital into the Bitcoin market, driving up demand and costs.

Nearly a 12 months later, when Trump, a presidential candidate who promised to make the USA a cryptocurrency pioneer, received the elections, Bitcoin costs reached new highs.

Different, more moderen occasions, like Trump’s announcement of a nationwide strategic crypto reserve, had related impacts in the marketplace.

Based on Greenspan, occasions like this final one will create future spikes in BTC’s value. For him, the brand new adoption cycle will concentrate on Bitcoin acquisition by complete nations.

Nationwide BTC Reserves Set to be Latest Market Driver

Whereas nations like the USA, China, and Ukraine presently maintain stockpiles of Bitcoin primarily seized from legislation enforcement actions, extra nations are intentionally buying extra Bitcoin for strategic functions.

El Salvador, for instance, has progressively elevated purchases of Bitcoin. At the moment, it holds a bit of over 6,000 in holdings. In the meantime, Bhutan’s Bitcoin stockpile has already surpassed the $1 billion mark.

Different jurisdictions, similar to Brazil, Poland, Hong Kong, and Japan, have additionally had lawmakers contemplate including Bitcoin to their fiscal reserves.

For Greenspan, these bulletins will generate actual change in BTC’s future buying and selling exercise.

“This bull run is especially about nation-state adoption. Let’s face it: as enjoyable and nostalgic as GameStop is, it merely can’t compete with the size and significance of complete nations moving into the Bitcoin area,” he stated.

Within the grand scheme of Bitcoin’s market, GameStop’s announcement, although notable, pales compared to the potential influence of large-scale occasions similar to nationwide coverage modifications or main financial shifts.