Ethereum, the second-largest cryptocurrency after Bitcoin, has skilled vital features these days at the same time as different digital belongings retreat from the latest market rally. CoinaMarketCap‘s information reveals that the token is buying and selling at $3,635, up 5% and 10% prior to now day and week, respectively.

This development, coinciding with Donald Trump’s victory within the U.S. presidential election, has highlighted a rising urge for food for threat belongings and Ethereum’s potential to interrupt key resistance ranges. Amid the rise, the market is watching the subsequent ETH value degree of $4,000 with the present bullish technical indicators and powerful fundamentals.

Among the many elements boosting ETH is leveraged ETF merchandise, which have reportedly skilled a considerable rise in demand since early November. The demand for VolatilityShares 2x Ether ETF rose 160% since November 5, Cointelegraph reported.

Within the three weeks because the election, investor confidence in threat belongings like Ethereum has surged, fueled partially by expectations of a extra favorable regulatory surroundings. Though Bitcoin led the surge with new all-time excessive costs, Ethereum’s value has been steadily climbing, positioning it as a strong-performing cryptocurrency within the coming months.

Ethereum Weekly Chart, Supply: CoinMarketCap

Ethereum moved from a low of $3,260 on Tuesday to a excessive of $3,685 on Thursday, representing a 13% improve in simply 2 days. ETH’s features are extra substantial on the month-to-month chart. The token has surged 37%, with technical indicators just like the Relative Power Index (RSI) and shifting averages suggesting sturdy bullish momentum.

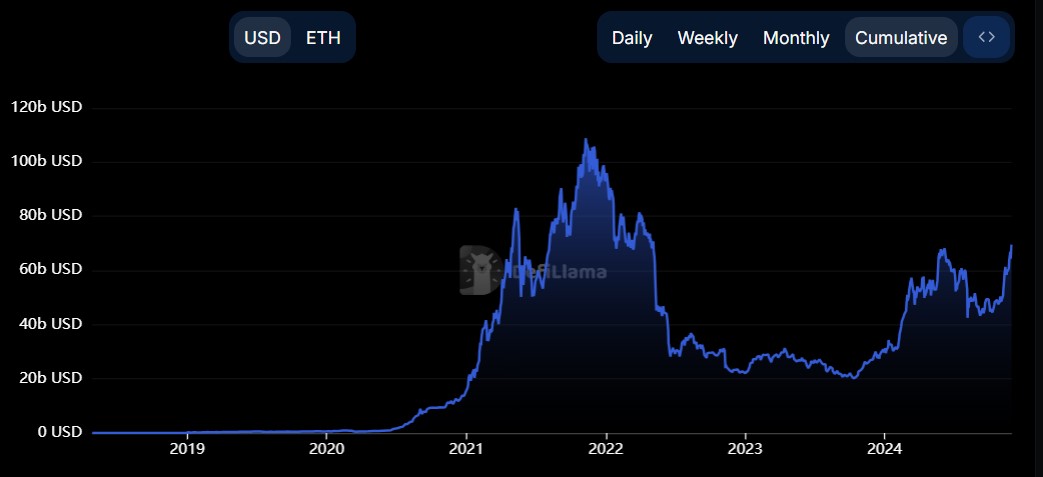

This optimism is additional fueled by the community’s dominant function in decentralized finance (DeFi), the place it instructions over half the whole worth locked throughout all platforms. Information from DefiLlama reveals that Ether has practically $70 billion in TLV, though barely decrease from 2021’s, greater than $100 billion.

Ethereum Complete Worth Locked, Supply: DefilLlama

Ethereum’s fundamentals stay sturdy, with rising on-chain exercise, new pockets creation, and elevated income. Layer-2 scaling options additionally entice builders and customers, enhancing the community’s scalability and competitiveness.

Bitcoin Issue

Bitcoin’s wrestle to interrupt previous the $100,000 mark might inadvertently profit Ethereum. Analysts speculate that Bitcoin’s range-bound buying and selling could divert investor consideration and funds towards Ethereum, pushing its value increased.

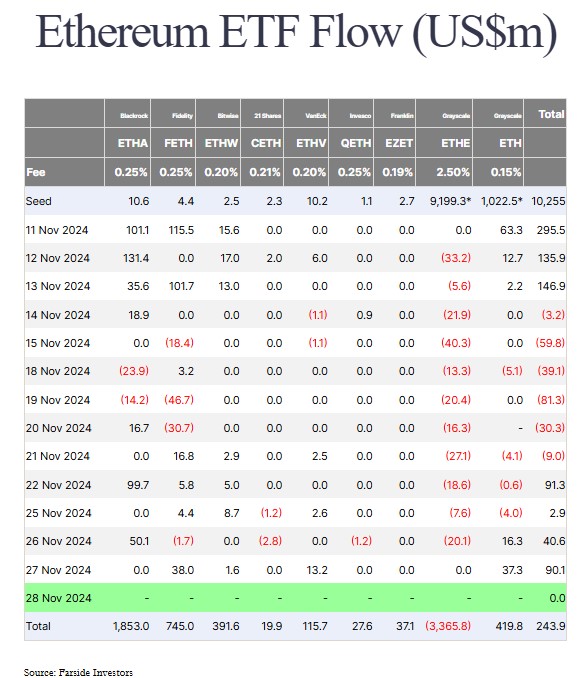

Moreover, Ethereum ETFs have logged constant inflows, with $90 million added over 4 consecutive days, in response to Farside information. Ethereum stays the spine of the DeFi ecosystem.

Ethereum ETF Flows, Supply: Farside Traders

Lido, Aave, and EigenLayer collectively maintain a major share of this worth. Stablecoin exercise on Ethereum has additionally surpassed Tron, with $60.3 billion in USDT now hosted on the Ethereum community, Coindesk reported.

The broader market sentiment round Ethereum has additionally benefited from Trump’s pro-crypto marketing campaign guarantees. His administration has signaled a discount in regulatory hurdles, sparking hopes of a DeFi resurgence within the U.S.