Ethereum struggles close to $1,600 as whales offload 143K ETH and derivatives inflows spike. Will ETH crash under $1,400?

With Bitcoin stagnating close to $84k, Ethereum fails to set off a trendline breakout rally. ETH is presently buying and selling at $1,581, following the formation of a day by day Doji candle.

As Ethereum continues to underperform, whales have begun offloading this week, and the community has recorded a brand new low. Can Ethereum handle to carry the $1,400 help degree amidst these situations?

Ethereum Caught at a Crossroads: Will Bears Take Management?

Ethereum fails to bounce again throughout the falling channel sample within the day by day chart. Going through opposition from a newly fashioned resistance trendline throughout the channel, the ETH value fails to drift above $1,600.

The upper value rejection within the latest day by day candle with lengthy wicks warns of a possible drop forward. Nonetheless, technical indicators recommend an optimistic probability.

The day by day RSI line reveals a sideways motion, hovering simply above the oversold boundary after a slight uptick. Moreover, the MACD and sign strains have given a constructive crossover, albeit nonetheless inside adverse territory.

These technical alerts point out the opportunity of a brand new bullish wave throughout the ongoing decline.

Based mostly on Fibonacci ranges, a breakout rally may first goal the 23.60% Fibonacci degree close to $2,000. If bulls handle to interrupt above the higher boundary, the 38.20% degree close to $2,400 turns into the following probably value goal.

Conversely, Ethereum reveals sturdy help round $1,400. A day by day shut under this degree may set off a possible drop towards $1,000.

Ethereum Offloading Season Begins?

Over the previous week, Ethereum skilled a minor surge adopted by stagnation, prompting whales to exit. In accordance with a latest tweet by crypto analyst Ali Martinez, Ethereum whales have offloaded 143,000 ETH, valued at over $226 million.

This vital offloading has lowered the steadiness of wallets holding 100–1,000 ETH from 9.4325 million to 9.2894 million. One notable case stands out.

Whales have offloaded 143,000 #Ethereum $ETH over the previous week! pic.twitter.com/n8cmwyUpER

— Ali (@ali_charts) April 17, 2025

One standout case: a long-dormant whale returned to the market after two years and deposited 1,161.77 ETH (price $1.84 million) into Kraken.

The entity realized a revenue of $ 480 Ok. Initially, the whale withdrew 943 ETH (then price $1.11 million) from Binance and later swapped 253.73K USDC for 146.59 stETH for staking.

By staking Ethereum, the whale earned an extra 72 ETH.

Lowest Ethereum Transaction Prices in 5 Years

Amid falling ETH costs, the community has hit a five-year low in transaction charges. In accordance with Santiment, Ethereum’s common community price has dropped under $0.17 for the primary time since Could 2020. Presently, the common transaction prices simply $0.168.

Declining charges recommend weakening demand and lowered consumer exercise, each potential precursors to a decrease ETH market valuation.

🚨💸 BREAKING: Ethereum charges are at a 5-year low, with transactions presently costing simply $0.168. That is the most cost effective day by day value of constructing $ETH transfers since Could 2, 2020. We briefly break this down in our newest perception. 👇https://t.co/fg5CfRgsHn pic.twitter.com/QlLwyzdm1F

— Santiment (@santimentfeed) April 16, 2025

As Ethereum struggles at a crossroads with the shaken confidence of whales, the derivatives market information an enormous influx. Traditionally, main influx spikes in Ethereum derivatives have resulted in main crashes.

On March 26, an influx of almost 65K ETH led to a 13% drop over 4 days. An identical spike final week resulted in an almost 20% decline.

On April 16, the biggest spike but — over 77K ETH — triggered fears of a deeper correction.

As Ethereum struggles to carry bullish floor, the elevated influx spike may result in a leverage-driven downfall to $1,000.

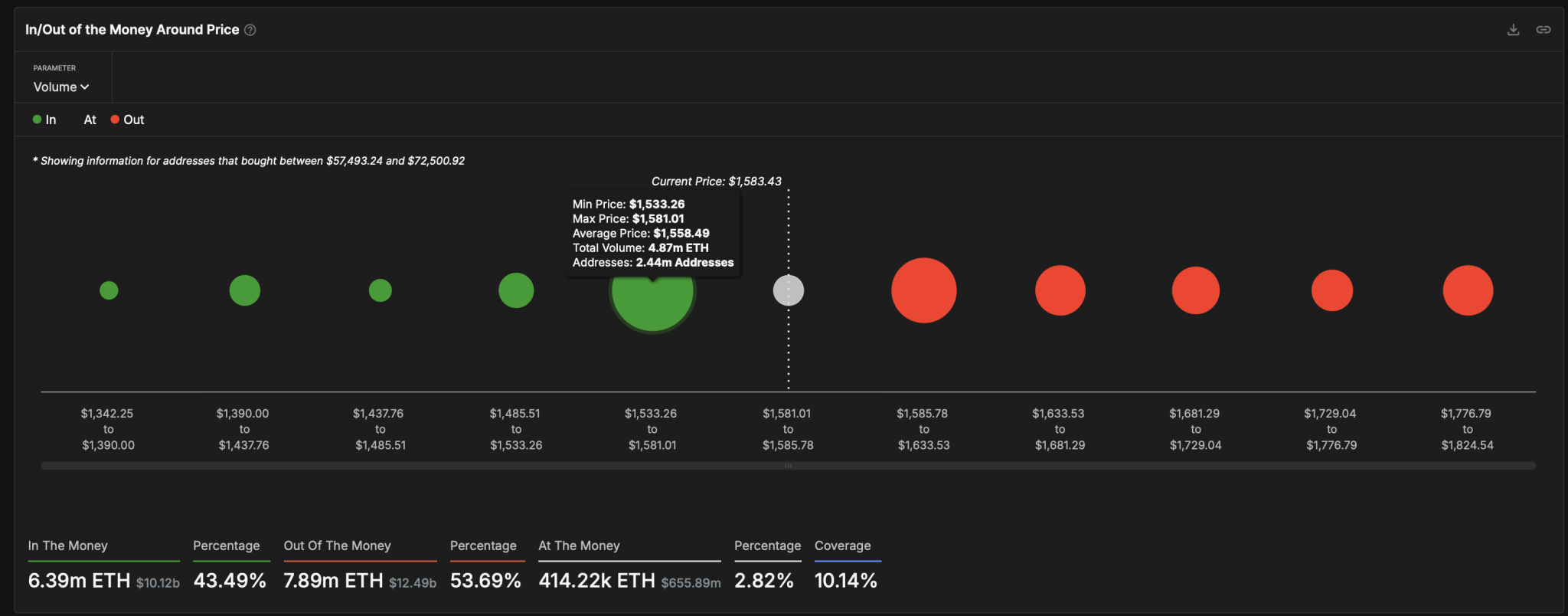

Based mostly on the In/Out of Cash Indicator from IntotheBlock, the help zone between $1,533 and $1,581 is the ultimate protection line. This demand zone holds 4.82 million ETH in 2.44 million addresses. If the value drops under this vary, the following help lies between $1,390 and $1,437.

Ethereum GIOM Indicator

Conversely, the important thing resistance stays the provision zone between $1,585.78 and $1,633.53, which holds 2.89 million ETH throughout 3.62 million addresses.

A profitable breakout may see ETH rise towards the $1,700 degree.