-

Ethereum noticed a latest worth restoration after a dip earlier in April.

-

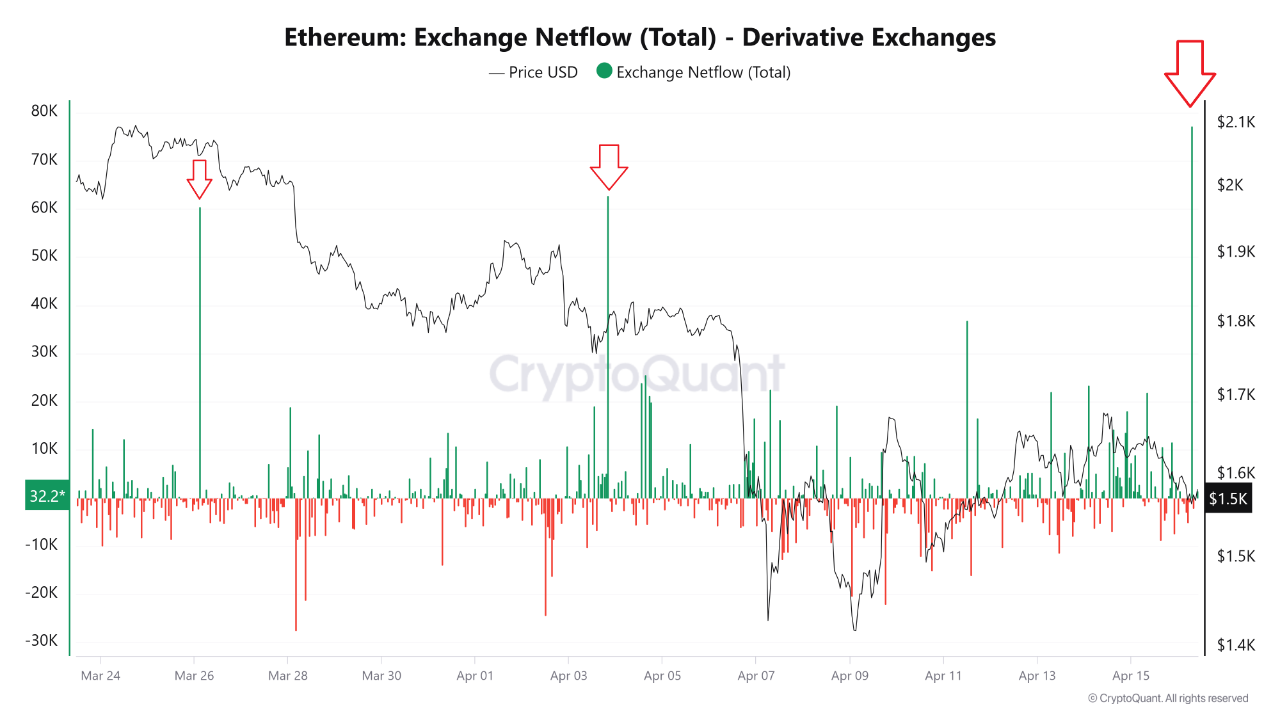

A big inflow of ETH to derivatives exchanges suggests potential hedging or quick positions, traditionally previous worth drops.

-

International financial uncertainty provides to the unstable outlook for Ethereum regardless of its latest positive factors.

Ethereum has been making headlines once more. After a pointy drop earlier this month, the world’s second-largest cryptocurrency is displaying indicators of restoration. On April 9 alone, ETH jumped 8.24%. Up to now 24 hours, it has climbed one other 1.5%. However recent on-chain knowledge is elevating some considerations – there’s been a big and strange circulate of ETH into derivatives exchanges.

Might this be a warning signal of one other dip?

A Rocky April for Ethereum

Ethereum started the month at $1,821.51. On April 2, the value briefly touched $1,957.94 however dropped again right down to $1,794.51 by the tip of the day.

From April 5 to eight, ETH fell greater than 18.86%. Since April 9, nonetheless, the market has proven indicators of restoration with a achieve of seven.82%.

The second week of April has been calmer. Between April 7 and 13, Ethereum edged up by 2.83%. This was a slight enchancment in comparison with the earlier week.

Nonetheless, over the previous seven days, the general achieve has been simply 0.1%, displaying that the market stays cautious.

Huge Inflows to Derivatives: A Pink Flag?

Yesterday, over 77,000 ETH have been moved to derivatives exchanges, based on the Ethereum Trade Netflow chart. That is the biggest day by day influx seen in March and April.

On the identical day, ETH’s worth dropped from $1,588.44 to $1,577.07—a 0.71% lower. At one level, it even hit a low of $1,537.28.

Such inflows often recommend merchants are making ready for draw back strikes—both by hedging their positions or opening shorts.

This isn’t the primary time we’ve seen this sample. Related, although smaller, inflows occurred on March 26 and April 3. In each instances, the market reacted with steep corrections.

From March 25 to 30, ETH dropped 13.05%. One other correction adopted from April 4 to eight, with the market falling by 18.92%.

Tariff Tensions and Crypto Volatility

Ethereum’s worth swings are additionally being formed by larger international points. The U.S. authorities’s aggressive tariff insurance policies below the Trump administration have precipitated turbulence throughout main asset courses, together with cryptocurrencies. Regardless that there’s now a 90-day pause on the coverage, uncertainty continues to have an effect on investor sentiment.

Since April 1, the general crypto market has slipped by 0.38%, whereas the altcoin market is down 4.42%. Ethereum alone has dropped by no less than 12.56% throughout the identical interval.

Ethereum Market Outlook: What Merchants Ought to Watch Subsequent

Ethereum had a robust run in recent times, rising 90.8% in 2023 and 46.1% in 2024. However this yr has began tough. Within the first quarter of 2025, ETH fell by 45.3%. That’s a pointy distinction to Q1 2024 and Q1 2023, when the market rose by 59.8% and 52.4%, respectively.

Whereas Ethereum is displaying some short-term restoration, the big inflows to derivatives exchanges are a possible warning signal. Mixed with ongoing international financial tensions, the short-term outlook stays unsure.

For now, Ethereum traders ought to keep alert – each to market charts and international headlines.