As Bitcoin trades above $95,000, a cryptocurrency on-chain analyst has highlighted particular technical indicators suggesting that the digital asset can hit the elusive $100,000.

This outlook aligns with the Thanksgiving vacation season, which has traditionally been a basis for Bitcoin to document value breakouts.

To this finish, the maiden digital asset has fashioned a narrowing wedge sample—a technical setup characterised by converging trendlines that point out a possible breakout. This sample locations the $99,000 goal in sight, in accordance with an evaluation by on-chain analyst Ali Martinez in an X submit on November 28.

Bitcoin’s bounce from key Fibonacci retracement ranges across the $94,000 zone additional helps this optimism. These ranges usually act as essential areas of help or resistance, reflecting renewed shopping for curiosity and the chance of pattern continuation.

Bitcoin avoids ‘Thanksgiving bloodbath’

Main as much as this yr’s Thanksgiving, Bitcoin’s bullish run from the post-election rally positioned it to focus on $100,000.

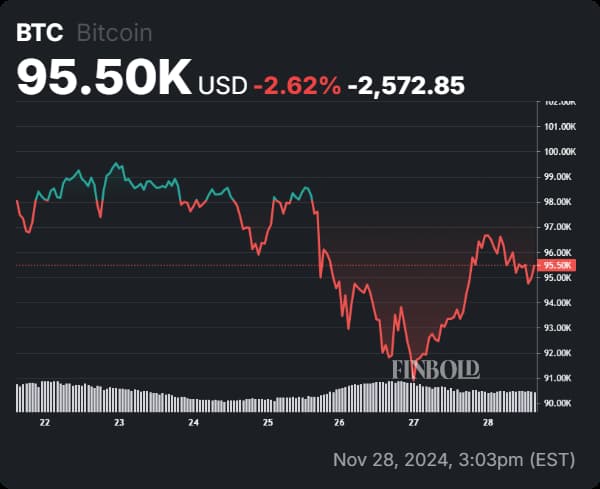

Nonetheless, this transfer appeared invalidated sooner or later because the maiden cryptocurrency confronted the specter of dropping beneath $90,000. The rebound to $95,000 resistance has helped erase issues of a repeat of the 2020 ‘Thanksgiving bloodbath.

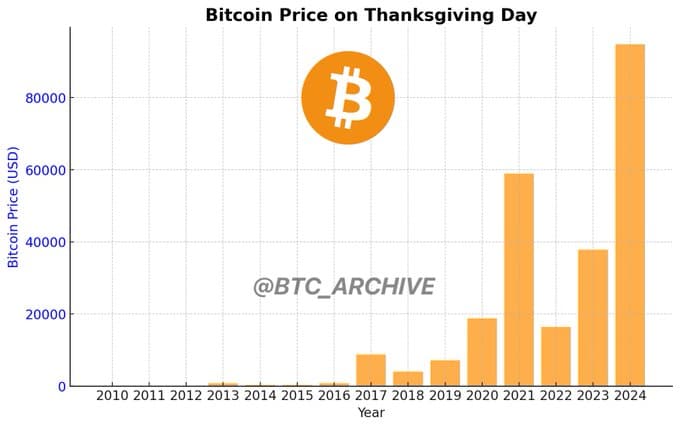

Bitcoin’s value has delivered bullish returns practically each Thanksgiving since 2010. The primary recorded Thanksgiving value in 2010 was a modest $0.28.

In 2024, Bitcoin is buying and selling at about $95,000, reflecting a staggering enhance of over 33 million %. On the identical time, on the present valuation, Bitcoin has rallied about 150% since 2023’s Thanksgiving vacation.

Bitcoin’s beneficial properties throughout the previous holidays included standout years like 2013 (6,401%) and 2017 (1,086%), whereas bear markets in 2014, 2018, and 2022 noticed declines of 54%, 54%, and 72%, respectively.

Bitcoin value evaluation

Bitcoin was buying and selling at $95,500 by press time, reflecting a 3% rally within the final 24 hours. Nonetheless, the digital asset stays within the purple on the weekly timeframe, down 2.6%.

At its present valuation, Bitcoin’s technical setup suggests the asset is probably on monitor to hit the $100,000 stage within the brief time period.

A few of the technical indicators supporting this outlook embody Bitcoin’s present buying and selling above the 50-day and 200-day easy transferring averages. On the identical time, the 14-day relative energy index signifies potential room for additional development, because the asset stays beneath overbought territory.

Featured picture by way of Shutterstock