Ethereum’s worth motion has been unstable in current weeks, however the asset encountered a major resistance zone.

With robust promoting strain probably at this degree, a rejection adopted by a short-term decline seems possible.

Technical Evaluation

By Shayan

The Day by day Chart

ETH lately discovered assist on the crucial $2.5K degree and has since jumped towards the $3K area, revisiting the beforehand damaged trendline of the descending wedge. Nonetheless, this upward motion seems to lack momentum, resembling a pullback quite than a sustained restoration.

Notably, the $3K area coincides with the 200-day transferring common, reinforcing it as a powerful resistance degree the place important promoting strain could emerge. Given this confluence, the probability of rejection is excessive, probably main to a different bearish transfer. If sellers regain management, Ethereum may decline additional, with the $2.5K degree remaining the first draw back goal within the mid-term.

The 4-Hour Chart

On the 4-hour timeframe, ETH’s current bullish retracement is clear as the value inches nearer to a key resistance zone. This space contains the decrease boundary of the beforehand damaged wedge and aligns with the 0.5 ($2.7K) and 0.618 ($2.9K) Fibonacci retracement ranges—each of which traditionally act as robust resistance zones.

With promoting strain probably concentrated inside this vary and bullish momentum showing weak, Ethereum could battle to interrupt larger. If rejection happens, the value may reverse towards the $2.5K assist degree, the place a crucial provide zone awaits.

Onchain Evaluation

By Shayan

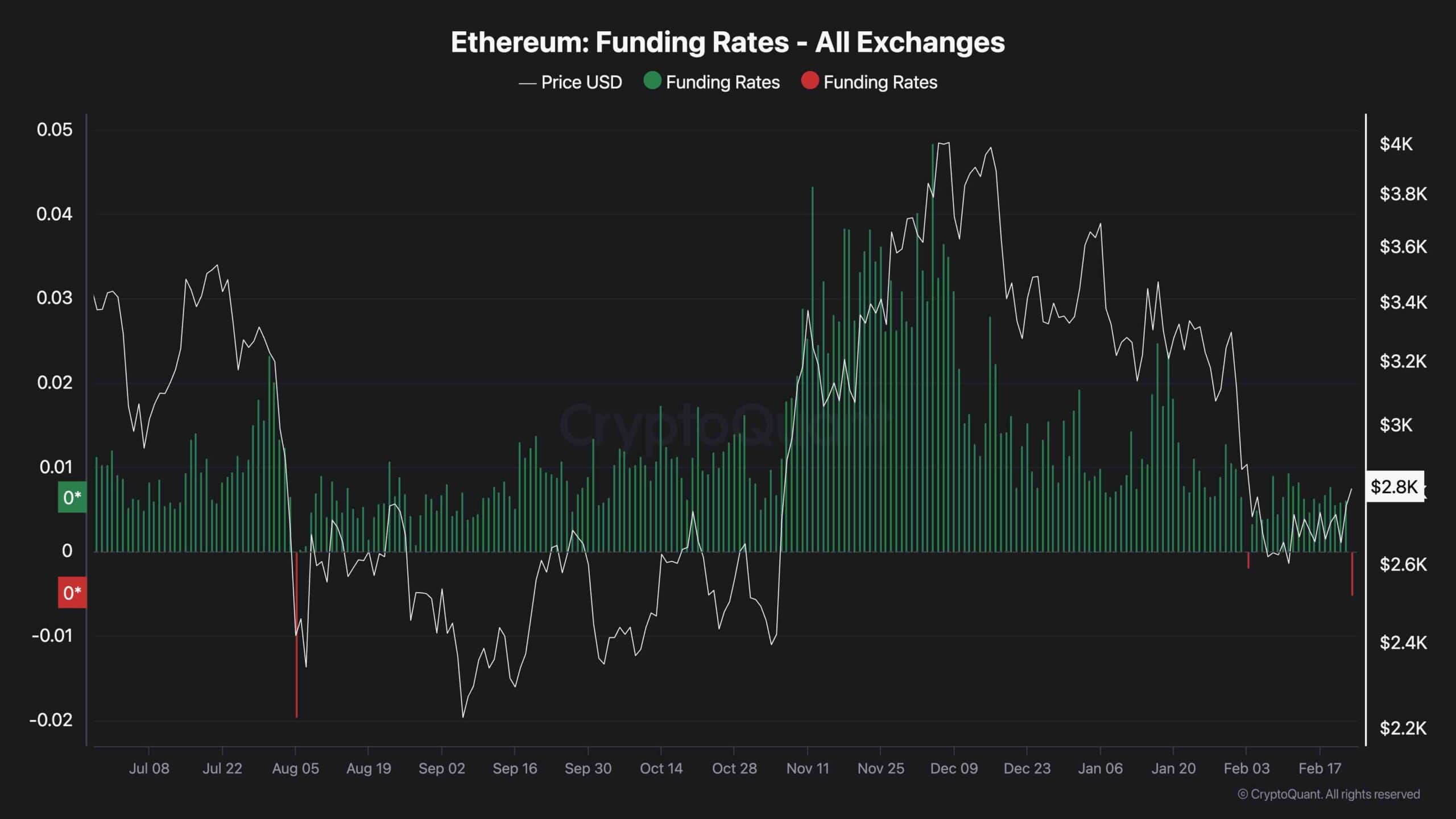

The current Bybit hack has raised issues amongst market members about its potential impression on worth traits. A vital metric to observe on this context is the funding fee, which displays the urgency of patrons and sellers in executing trades.

As illustrated within the chart, funding charges have skilled a pointy decline through the newest market turbulence, even turning adverse. This drop suggests heightened promoting strain and fear-driven exercise in response to the hack. If this pattern persists, notably with continued resistance on the $3K degree, additional declines may comply with, with sellers eyeing $2.5K as the following main assist.

Traditionally, such steep drops in funding charges typically result in a part of sideways consolidation with elevated volatility. On this case, the $2.5K–$3K vary may act as the first buying and selling zone till market sentiment stabilizes.